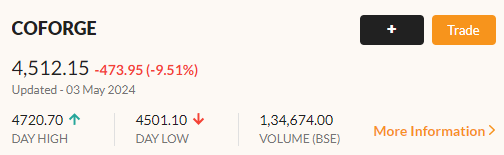

Stock Market Today: The Coforge share price Ltd was corrected by more than 9% during the morning trades on Friday. The company posted Q4 earnings performance on Thursday post-market hours

Stock Market Today: During Friday’s morning trading, Coforge Ltd.’s share price had a correction of over 9%. Coforge Ltd. released its Q4 financial results after market hours on Thursday.

For the quarter that ended in March of 2024, Coforge recorded a 95% increase in net profit to ₹224 crore. Consolidated sales for the three months ending March 31 rose 8.7% year over year to ₹2,359 crore.

However, the performance fell short of some experts’ projections.

In response to the results, analysts at Jefferies India Pvt Ltd stated that the performance was below average overall.

Jefferies downgrades ratings

Coforge’s 4QFY24 revenues of US$287 million (rising 1.9% sequentially in constant currency terms), a 65bps sequential rise in EBITDA margins, and normalized profit of Rs2.3 billion, all were both below expectations, said analysts at Jefferies.

The main negative surprise in the results was the slower-than-expected margin expansion as per Jefferies. Top-5 customers and Banking Financial Services (up 6.4% sequentially) were the primary drivers of revenue growth.

Who was Joshua Dean? Boeing Whistleblower Dies. “Sudden, Fast-Spreading Infection,” Says Report.

The IT companies see a slowdown in spending by clients leading to uncertainties over revenue and profitability outlook.

At $775 million, Coforge’s fresh order intake was robust, bolstered by two significant agreements. However, a significant negative surprise was that Coforge did not provide growth guidance for FY25 which as per analysts at Jefferies implies increased demand uncertainty.

Amid moderating growth and repeated disappointment on margins, a large acquisition as per Jefferies adds another layer of execution risk, warranting a derating. Coforge has signed a definitive agreement to take over Cigniti Technologies Limited.

Besides an Imminent QIP should be an overhang, too as per Jefferies who have cut their earnings estimates by 11-16% and lowered their target price to Rs4,290 based on 20 times price to earnings valuations and hence have downgrade rating to underperform

Who is Kishori Lal Sharma, Congress’s Amethi pick?

Antique Stock Broking cuts target price

Analysts at Antique Stock Broking have lowered Coforge’s target price to ₹6,200 (from ₹6,900 earlier) as have lowered their forward valuation (price to earnings) multiples to 30 times (from 32 times earlier) due to the reduced near-term growth outlook. They expect some slowdown in Coforge’s growth in FY25 after reporting strong double-digit growth in FY24.

PhillipCapital Institutional Equity Research remains optimistic about the FY25 Outlook and maintains a Buy Rating

Phillip Capital in their post-result report said that they now value Coforge at 28 times FY26 EPS (versus 30 times earlier) on lower margins. Their Price target stands at ₹6030 (versus ₹7110 earlier)

Conference League semi-final first leg: Olympiacos upset Aston Villa.

A strong order intake year to date, a strong 12-month executable order book, a healthy large deal pipeline, and a travel vertical (18% of revenue) rebounding after weak FY24 performance, should help Coforge’s growth to remain in the leader’s quadrant, believe analysts at PhillipCapital.

Analysts at PhillipCapital said that Prima facie the acquisition seems to fill in the portfolio gaps within Coforge, however successful integration will be key given the size (20% of Coforge Revenue).

Reader Interactions