For the seventh time in a row, the RBI has maintained the repo rate at 6.5%; 4.5% is predicted for CPI inflation in FY25.

On April 5, Governor Shaktikanta Das announced the decision of the Reserve Bank of India’s Monetary Policy Committee, stating that policy repo rates will remain at 6.5%.

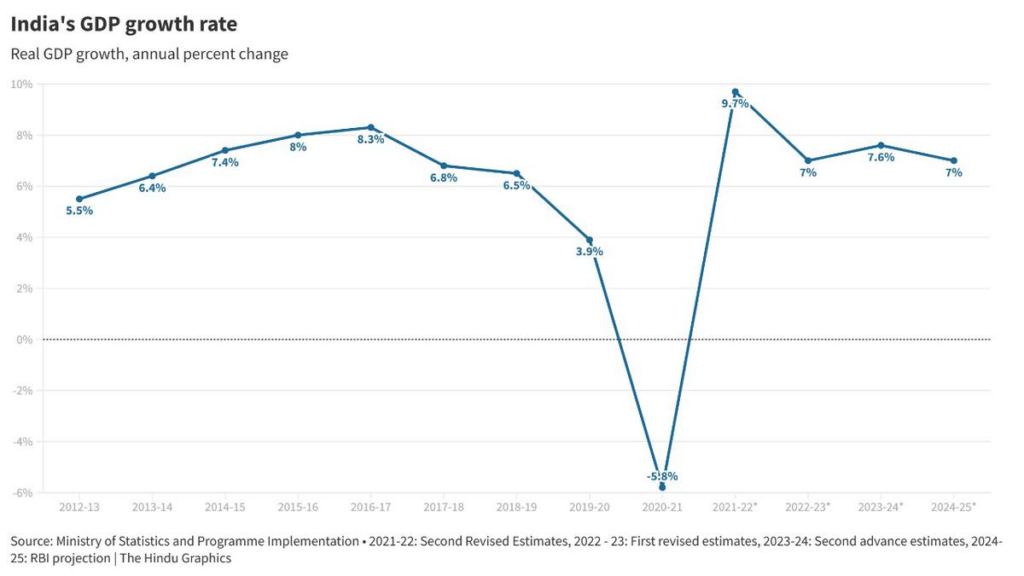

Furthermore, the RBI maintained its forecast of 7% GDP growth for the fiscal year 2024–2025, with 6.9% and 7% growth anticipated in the quarters of June and September, respectively. Growth is expected to be at least 7% in the third and fourth quarters. This is less than the 7.6% growth that is anticipated for FY24.

Also Read: New Gen Honda Amaze Coming With Full Features Like Honda City in Half Price.

Read live updates here:

Highlights of RBI’s first bi-monthly policy statement for FY’25

- The benchmark interest rate or repo rate kept unchanged at 6.5%

- GDP growth for 2024-25 retained at 7%, lower than 7.6% last fiscal

- Retail inflation to average 4.5% this fiscal, lower than 5.4% in FY25

- Net inflows by foreign portfolio investors (FPI) stood at $41.6 billion during 2023-24, the second highest level of FPI inflow after 2014-15

- Current Account Deficit in 2024-25 to remain at a level that is both viable and eminently manageable

- The Indian rupee remained largely range-bound as compared to its emerging market peers as well as a few advanced economies during 2023-24. INR most stable among major currencies in FY24

- The next monetary policy committee (MPC) meeting is scheduled for June 5 to 7, 2024.

A look at how India’s GDP growth rate has changed

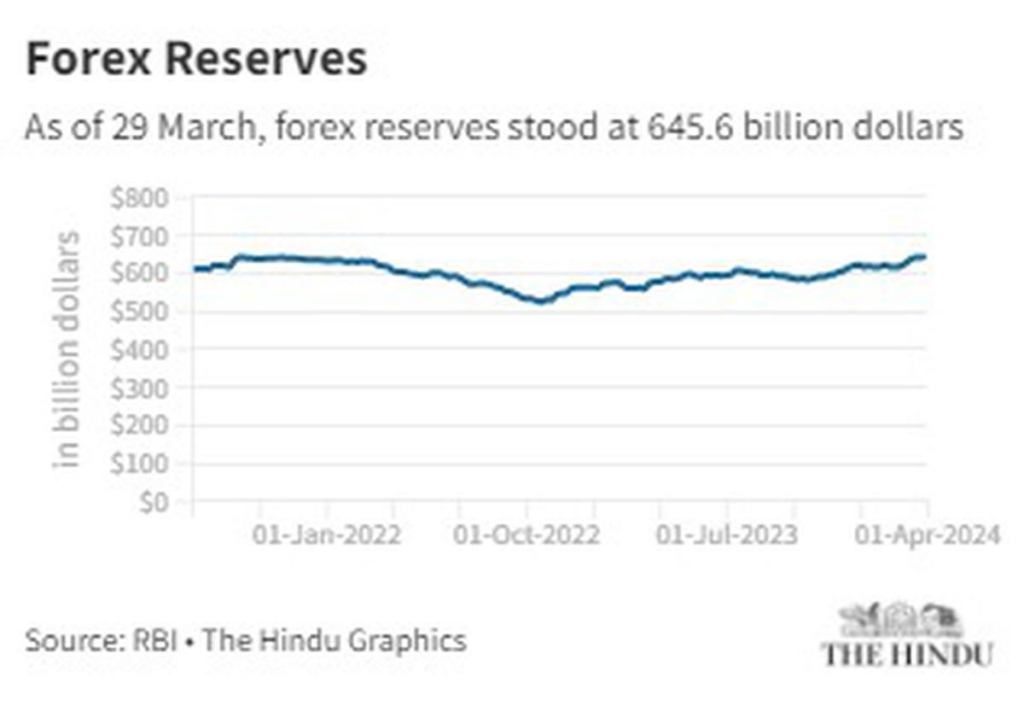

A look at how the Forex reserves have changed over the last three years

Domestic economic activity remains resilient: RBI

The MPC observed that robust investment demand and positive corporate and consumer attitudes support the resilience of domestic economic activity. Although headline inflation has dropped from its peak in December, pressures from food prices have been disrupting the ongoing disinflation process, making it more difficult for inflation to eventually decline to the target level. The forecast is uncertain due to unpredictable supply-side shocks from unfavorable climate events and their effects on agricultural output, as well as geopolitical tensions and their effects on trade and commodities markets, according to Mr. Das.

On April 5, the Monetary Policy Committee (MPC) determined to maintain the policy repo rate at 6.50% under the liquidity adjustment facility (LAF). The rates have been put on hold for the seventh time.

The MPC also decided to keep its attention on removing accommodation to boost growth while ensuring that inflation gradually approaches the objective.

Food price uncertainties continue to weigh on inflation outlook: RBI

In the future, inflation the future would be affected by the uncertainty surrounding food prices. However, the RBI stated that a record amount of rabi wheat will be produced in 2023–2024, which will assist in controlling grain prices when it announced the Monetary Policy’s decision to keep the CPI inflation rate at its current level.

Positive early signs of a typical monsoon also portend positively for the kharif season. The growing frequency of climate shocks, however, continues to be a significant upward risk to food prices.

Concerns are also raised by low reservoir levels, particularly in the southern States, and the prediction of above-average temperatures in April and June. Close observation is required of the pricing of important vegetables and the tight supply and demand situations for some pulses.

With the recent decrease in LPG prices, fuel price deflation is probably going to get worse shortly. Firms are experiencing cost-push pressures that are biased upward after a period of consistent moderation. It is important to keep a careful eye on the current strengthening of crude oil prices internationally.

The forecast for inflation is further threatened by geopolitical unrest and financial market volatility, the RBI noted.

Headwinds from geopolitical tensions pose risk: RBI

In a press release announcing the Monetary Policy Committee’s decision, the RBI stated that the outlook for fixed investment is still positive due to signs of an upturn in the private capex cycle, solid government capital expenditure, healthy corporate and bank balance sheets, and business optimism.

However, risks to the projection include headwinds from increased Red Sea disruptions, volatility in global financial markets, geoeconomic fragmentation, geopolitical tensions, and extreme weather events.

Services activity likely to grow to above pre-pandemic trend: RBI

A typical southwest monsoon is predicted for the future, which should aid in agricultural production. The RBI stated that it will maintain the 7% GDP growth forecast for FY25 as part of its bi-monthly Monetary Policy decision, citing the industry’s predicted continuation of strong profitability.

It is expected that services activity will increase above the pre-pandemic trend. Growth in private consumption should accelerate as rural activity continues to improve and urban demand remains stable. The Reserve Bank said in a news statement that rising discretionary expenditure anticipated by urban households, as indicated by the consumer survey, and rising income levels bode well for the expansion of private consumption.

Domestic economic activity continues to expand at an accelerated pace: Das

#Watch | India presents a different picture on account of its fiscal consolidation and faster GDP growth. Turning to domestic growth, domestic economic activity continues to expand at an accelerated pace, supported by fixed investment and an improving global environment. The… pic.twitter.com/D5oZzjygpk

— DD News (@DDNewslive) April 5, 2024

India’s Forex reserves reach all-time high

As of March 29, 2024, India’s foreign exchange reserves were at an all-time high of $645.6 billion, according to Governor Das.

He referenced the most recent statistics on several external risk indicators, suggesting that India’s external economy has become more resilient.

He continued, “We are still confident that we will be able to easily meet our external financing requirements.”

Headline inflation has eased to 5.1% in Jan and Feb: Das

Growth has continued to sustain its momentum, surpassing all projections. Headline inflation has eased to 5.1% during both January and February, and this has come down to 5.1% in these two months from the earlier peak of 5.7% in December, the RBI Governor said.

Looking ahead, robust growth prospects provide the policy space to remain focused on inflation and ensure its descent to the target of 4%, he adds.

CPI inflation for FY25 projected at 4.5%

In delivering the Monetary Policy decision, Governor Das stated that 4.5% CPI inflation is anticipated for FY25. The Committee has kept the February numbers the same.

In February, it was predicted that CPI inflation would be 5.4 percent in 2023–2024 and 5.0 percent in Q4 of that year.

Pressures on food prices increased in February, and the RBI Governor said the MPC is still on the lookout for inflation risks.

He went on to say that persistently high food prices could undermine the foundation of inflationary expectations.

The Standing Deposit Facility rate remains at 6.25%: Das

The Standing Deposit Facility rate remains at 6.25% and the Marginal Standing Facility rate and Bank Rate remain at 6.75%, RBI Governor Shaktikanta Das said on Monetary Policy decisions.

Real GDP growth for FY25 projected at 7%

The Monetary Policy Committee has projected the real GDP growth for FY25 at 7%.

This is also consistent with its announcement made previously in February.

Monetary policy must remain actively disinflationary at this stage: Das

In his remarks announcing the Monetary Policy Committee’s decision, RBI Governor Shaktikanta Das stated that strong growth gives room for monetary policy to continue focusing on bringing inflation down to its 4% target.

According to Mr. Das, monetary policy must continue to be actively disinflationary at this point.

The Monetary Policy Committee decides to keep the policy rate unchanged at 6.5%

The Monetary Policy Committee has decided to keep the policy rate unchanged at 6.5%.

The central banking authority of India has kept the repo rate unchanged for the last six consecutive MPC meetings.

The decision was made with a majority of 5:1

Reader Interactions