When it comes to investing in mutual funds, many people are looking for options that can offer both growth and stability. One such option is the Bajaj Finserv Large Cap Fund, which stands out in the crowded market of equity mutual funds. In this article, we’ll explore what makes this fund unique and why it could be a suitable choice for your investment portfolio.

Bajaj Finserv Large Cap Fund

What is a large cap fund

Before diving into the specifics of the Bajaj Finserv Large Cap Fund, let’s first understand what a large cap fund is. Large cap funds invest primarily in the biggest companies in the market, typically those ranked between 1 and 100 based on their market capitalisation. These companies are usually well-established, financially stable, and have strong fundamentals.

Investing in large cap funds is often considered less risky compared to smaller companies. This is because large companies are less sensitive to market fluctuations and tend to offer relatively consistent returns. As a result, large cap funds are suitable for investors looking for long-term growth with relatively low volatility.

Unique features of Bajaj Finserv Large Cap Fund

The Bajaj Finserv Large Cap Fund sets itself apart from other large cap funds through its concentrated investment strategy. Here are some of the key features that make this fund unique:

Concentrated strategy

Unlike many funds that invest in a large number of stocks, the Bajaj Finserv Large Cap Fund focuses on a smaller, concentrated portfolio of just 25 to 30* stocks. This concentrated approach allows fund managers to invest in companies they believe have the strongest growth potential. By focusing on fewer stocks, the fund aims to optimize returns while managing risk.

Focus on champions of corporate India

The fund targets companies that are leaders in their industries, often referred to as the ‘Champions of Corporate India.’ These are the firms that have significantly contributed to the country’s economic growth and are expected to continue doing so. Investing in such companies not only offers potential for financial growth but also aligns with the broader growth story of India.

Strong financials and resilience

The stocks in this fund are selected based on their strong financial health. These companies usually have solid balance sheets, healthy cash flows, and diversified revenue sources. Such financial strength can provide stability during economic downturns. High-quality companies tend to perform relatively better during tough times and are usually quicker to recover from market dips.

High-conviction stock selection

The Bajaj Finserv Large Cap Fund is characterized by high-conviction stock selection. This means that the fund managers have a strong belief in the growth potential of the selected stocks. This selection is based on thorough research and analysis, focusing on companies with a consistent track record of performance. By betting on high-conviction stocks, the fund aims to deliver returns that beat the broader market in long term.

High active share

Another distinctive feature is its high active share. This measures how much the funds holdings differ from its benchmark index. A high active share means the fund is not just mimicking the index but is actively managed, allowing for greater opportunities to outperform the market. This indicates a significant level of involvement from the fund managers in selecting stocks.

Why now is a good time to invest

India is one of the fastest-growing economies in the world, which makes it an attractive environment for large cap investments. These investments are poised for global expansion, especially as large Indian companies increasingly compete on the international stage.

In recent years, large cap stocks have shown robust growth. They tend to fall less than smaller stocks during downturns and usually recover faster. However, past performance may or may not be sustained in the future. With many large cap stocks trading close to their fair valuation, now could be a good time to invest for the long term.

Advantages of large cap funds

Investing in large cap funds, including the Bajaj Finserv Large Cap Fund, comes with several advantages:

Relative stability: Large cap companies are generally relatively stable and less affected by market swings. This makes them a suitable choice for investors looking for less volatility.

Returns: While the growth potential may not be as high as that of smaller companies, large caps have a strong track record of performance and profitability.

Dividend payouts: Many large cap companies regularly pay dividends, providing a steady income stream for investors. Reinvesting these dividends can enhance growth potential.

Liquidity: Large cap stocks are usually highly liquid, meaning they can be easily bought and sold in the market, making them a flexible investment option.

Bajaj Finserv Large Cap Fund: The importance of a long-term perspective

Investing in large cap funds through a Systematic Investment Plan (SIP) necessitates a long-term viewpoint. Although short-term market fluctuations can occur, history indicates that large cap stocks possess the resilience to recover and grow over time. Investors who remain committed to their strategy and avoid the urge to time the market are more likely to benefit from compounding returns and capital appreciation.

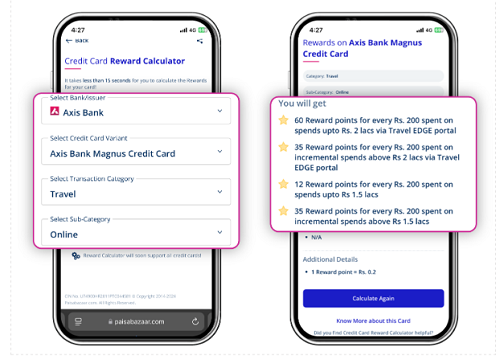

The Bajaj Finserv Large Cap Fund exemplifies this long-term approach by prioritizing quality over quantity, focusing on sustainable growth, and maintaining a disciplined investment strategy despite short-term market noise. Additionally, using a SIP return calculator can help investors project potential gains, further reinforcing their commitment.

Conclusion

The Bajaj Finserv Large Cap Fund offers a unique investment proposition for those looking for stability, growth-oriented portfolio. With its concentrated strategy, focus on strong companies, and potential for long-term gains, this fund could be a valuable addition to your investment strategy. Whether you’re new to investing or a seasoned investor, considering large cap funds like this one might help you achieve your financial goals.

*The above investment strategy is based on prevailing market conditions and opportunities available at the time of investment. The Fund Manager reserves the right to change the count of stocks invested based on the SID and the opportunities available at the time of investment done, Position in derivatives will not be considered for the computation of total number of stocks in the portfolio.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Bajaj Finserv Large Cap Fund

An open ended equity scheme predominantly investing in large cap stocks

This product is suitable for investor who are seeking*

wealth creation over long term

to invest predominantly in equality and equity related instruments of large cap companies

Investors should consult their financial advisers if in doubt about wheather the product is suitable for them

Reader Interactions