Stock Market Closing Bell on April 10, 2024: Equity markets were rangebound with a positive bias on Wednesday as investors await fresh triggers for directional moves. The S&P BSE Sensex ended with gains of 354 points, or 0.47 percent, at 75,038 levels, while the Nifty50 closed at 22,754, up 111 points or 0.49 percent.

ITC, Kotak Bank, SBI, Tech M, Bharti Airtel, Asian Paints, JSW Steel, Infosys, and Reliance Industries were the top winners on the 30-stock index, rising between 1 percent and 2 percent.

Meanwhile, in the broader markets, outperformed the market with the BSE MidCap index and the BSE SmallCap index advancing 0.89 percent and 0.46 percent, respectively.

Among sectors, the Nifty PSU Bank, FMCG, Media, and Metal indices gained in the range of 1.23 percent to 1.80 percent, while Pharma and Auto indices ended in the red.

Tech View:: ‘Decisive move above 22,750 in Nifty might induce a rally towards 23,000’

The Nifty mostly remained sideways today as investors preferred to wait ahead of the US CPI inflation data, which could potentially impact rate cuts by the Fed. The resistance zone is placed at 22,700-22,750, while support is at 22,600. A decisive move above 22,750 might induce a rally towards 23,000 in the short term. Since the market appears to be range-bound, buying on dips and selling on rallies might prove to be a good strategy with proper stop-loss measures.

Comment :: ‘Investors remain fixated on impending release of the FOMC minutes, US inflation data’

Indian markets sustained their upward momentum, buoyed by a robust performance in the broader market, albeit slightly lagging behind its Asian and European counterparts. Investor attention remains fixated on the impending release of the FOMC minutes and US inflation data later today. Following the release of strong US job data, market sentiments are inclined towards an anticipation of spike inflation, thereby reducing the likelihood of a near-term rate cut. Additionally, Fitch’s recent downgrade of China’s credit rating could potentially reverberate through the global economy, warranting a caution.

Currency check:: Rupee gains 12 paise vs US dollar, ends at 83.19/$

Broader markets :: MidCap index adds nearly 1%

Sectoral trends :: Nifty PSU Bank, Media rally up to 1.8%

Sensex Heatmap:: ITC, SBI, and Airtel end as top gainers on the 30-stock index

Closing Bell:: Nifty holds 22,750

Closing Bell:: Sensex ends 354 pts higher ahead of US CPI data

Vodafone Idea stock may more than half amid subscriber churn: CLSA

“Beyond the planned capital expenditure and 5G rollout, Vi faces a financial crunch in FY26CL. Annual spectrum and AGR payments of $4 billion per annum will fall due unless the government converts debt principal to equity at the end of the moratorium,” CLSA said in its latest report.

Tata Motors-owned JLR India sales rise 81% at 4,436 units in FY24

Retail sales of SUVs, Range Rover, and Defender continued to grow with year-on-year increases of 160% and 120% respectively.

Vodafone Idea to launch FPO next week seeks to raise Rs 18,000-20,000 cr

Vodafone Idea (Vi) is preparing to launch a follow-on public offer (FPO) to raise Rs 18,000-20,000 crore by the middle of next week, reported Moneycontrol, citing sources.

Q4 Preview: TCS to lead IT pack; may see upper single-digit rise in profit

Large-cap IT major TCS is expected to register a single-digit growth in revenue and profit for the January-March quarter (Q4FY24) as compared to the same quarter in the year-ago period due to large deal ramp-ups and operational efficiencies, said analysts.

Beware of deep fake of CEO recommending stocks, says National Stock Exchange

India’s National Stock Exchange (NSE) on Wednesday cautioned investors against deepfake videos of its chief executive giving stock recommendations.

RInfra tanks 20% as SC asks co to refund Rs 8,000 cr to Delhi Airport Metro

Shares of Reliance Infrastructure (R-Infra) tanked 20 percent to Rs 227.40, freezing at the lower circuit on the BSE on Wednesday at 01:28 PM, amid heavy volumes after the Supreme Court (SC) set aside the Rs 8,000-crore arbitral award in favor of the company’s metro arm, Delhi Airport Metro Express Private Limited (DAMEPL).

Summer cheer for beer firm United Breweries as margins remain stable

United Breweries, India’s largest beer manufacturer, is expected to gain business as summer brings heat waves. The company will be a major beneficiary from April to July, the period that contributes 40-45 percent of its annual beer volumes. The T20 Cricket World Cup in June and the ongoing Indian Premier League will help volumes and should offset the negative impact of elections on sales.

Rotation into large-caps could continue ahead of elections: Ritu Arora

Indian markets have rebounded sharply from their lows in mid-March with the Sensex crossing the 75,000 mark for the first time this week. RITU ARORA, chief executive officer and chief investment officer for Asia at Allianz Investment Management, tells Puneet Wadhwa in an email interview that the Indian markets will witness periodic corrections and provide better entry opportunities over the next year.

Kolte Patil zooms 10% as Motilal Oswal gives a ‘Buy’ rating, 34% upside eyed

Shares of the company soared as much as 10.05 percent to hit an intraday high of Rs 569.05 per share after Motilal Oswal initiated coverage on the real estate developer.

SC sets aside Rs 8,000 cr arbitral award to Anil Ambani’s Reliance Infra

In a significant relief to the Delhi Metro Rail Corporation (DMRC), the Supreme Court on Wednesday set aside the Rs 8,000 crore arbitral award in favor of Anil Ambani-owned Reliance Infrastructure’s metro arm, Delhi Airport Metro Express Private Limited (DAMEPL).

KSB rallies 5% as board to consider stock split; stock up 98% in 1 year

The company’s board is scheduled to meet on April 26 to consider the proposal for sub-division/split of equity shares and also announce the March quarter results.

Global check:: Hang Seng surges 1.8% in mixed trade in Asia

Will India be the world’s next growth driver as its economic growth speeds up?

With China’s growth slowing, India could become the new engine of global economic growth, but it will take strategic investments, increased labor participation, and more to achieve its ambitions.

Explained: Silver prices may touch Rs 1 lakh, should you invest?

Motilal Oswal has cited several factors driving silver prices, including strong demand from the industrial sector (electronics, solar) and its role as a safe-haven asset during economic uncertainties.

Motilal Oswal trims price target on TaMo, sees 4% downside, Here’s why

MOFSL said the revised price highlights expectations of stabilizing growth shortly due to moderate volume growth in domestic passenger and commercial vehicle industries.

Vistara’s loss may not be IndiGo’s gain; oil remains an overhang: Analysts

Surging oil prices, according to analysts, could hit the airline if the government decides to hike the prices of aviation turbine fuel (ATF).

Fitch downgrades China’s outlook to negative on economic growth risks

China’s factory output and retail sales topped forecasts in January-February, joining better-than-expected exports and consumer inflation indicators, providing an early boost to Beijing’s hopes.

Gold can rise 5% to Rs 75,000; Silver by 2.5% to Rs 85,000, charts suggest

Commodities such as Gold and Silver have rallied sharply in the last two weeks amid a rise in geopolitical crisis and hopes of interest rate cuts in the US.

Gold futures in the international market rallied from $2,170 per ounce to $2,384 per ounce – up 9.9 percent in the last three weeks. Meanwhile, Silver futures outperformed with a gain of 16 percent during the same period.

Vedanta soars 8%, hits 23-month high on heavy volumes; zooms 45% in 4 weeks

The company is favorably positioned to capitalize on the commodity upcycle, thanks to its diversified exposure. Moreover, its ongoing efforts to enhance capacity and profitability across various segments bode well for prospects, as per reports.

ALERT:: Kolte Patil zooms over 7% as MOFSL initiates coverage

>> With the scale-up in operations, we expect post-tax OCF to double to INR8b by FY26. Further, the net cash position as of Dec’23 also provides comfort and ample headroom to capitalize on future growth opportunities. We initiate coverage on the stock with a BUY rating and a TP of INR700, implying a 34% upside.

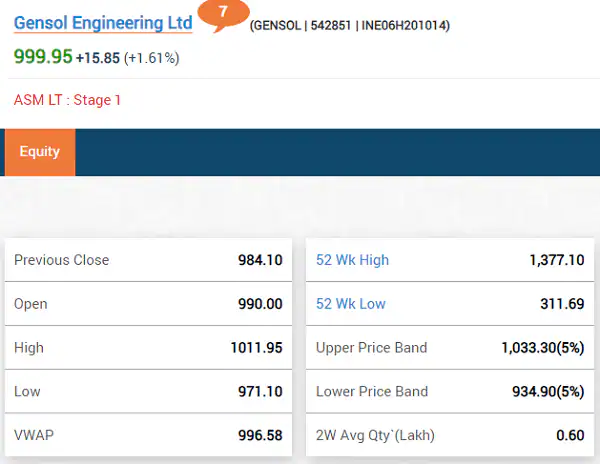

ALERT:: Gensol Engineering reports an order book of Rs 1,783 crore at the start of FY25

PB Fintech surges 7%, hits 2-year high on pact with ICICI Lombard

Stocks of PB Fintech are trading at their highest level since November 2021. It had hit a record high of Rs 1,470 on November 17, 2021. At 09:21 am, the stock was trading 5 percent higher at Rs 1,369.85, as compared to the 0.33 percent rise in the S&P BSE Sensex. On the other hand, shares of ICICI Lombard General Insurance Company were quoting 1 percent higher at Rs 1,713 on the BSE.

Weak demand environment to delay recovery in quick-service restaurants

While competition is intense, growth has seen non-vegetarian options starting to outpace vegetarian. KFC, for example, has an 85 percent contribution from non-vegetarians. Popeyes, with a launch in South India, is creating a new category in fried chicken.

Comment :: Here’s what could keep markets resilient

Robust economic growth, decent corporate earnings, macroeconomic stability, expectations of political stability after elections, sustained capital flows, and retail investor enthusiasm will keep the market resilient despite rich valuations.

A significant recent healthy trend in the market is the outperformance of the fundamentally strong large caps over the mid and small caps. This trend is making the market healthier and, therefore, has the potential to continue. Largecap banking stocks are likely to be the leaders if the rally sustains.

The US CPI data to be published today is significant since that will determine the quantum of rate cuts by the Fed this year. The fact that US inflation has come down by two-thirds is significant and positive from the market perspective, but the trajectory of inflation, going forward, will largely influence the direction of stock markets, globally.

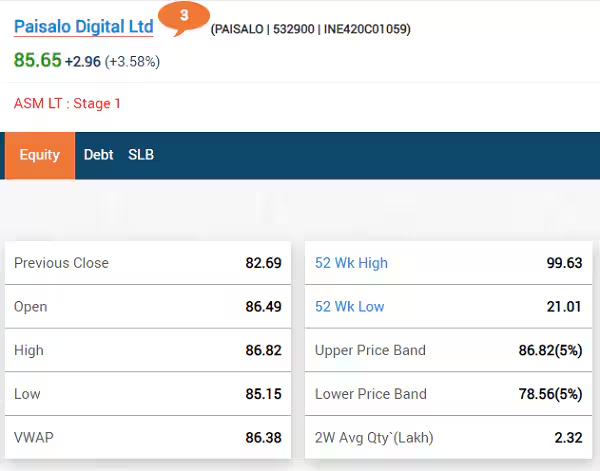

Paisalo Digital gains over 3.5% on a 32% YoY rise in AUM

>> The company reported that its Assets Under Management (AUM) saw a 32 percent growth, reaching Rs 4,622 crore by the end of the March FY24 quarter.

>> In the same period, disbursements rose by 38 percent to Rs 3,588 crore

Shyam Metalics advances 3% as it plans Rs 750-cr capex

>> The metals manufacturing firm will set up a new facility for the production of stainless steel hot rolled coils (HRC) at its existing plant in Sambalpur, Odisha with an investment of Rs 650 to Rs 750 crore

Protean eGov Technologies zooms about 3% as Co to likely launch QIP

>> Reports say the QIP offering is set to include a base issue size of Rs 170 crore along with a green shoe option of Rs 75 crore

Godrej Properties flat after Gurugram unit of RERA denies project extension

>> The Real Estate Regulatory Authority in Gurugram has denied the extension application for the Godrej Air Phase 4 project, a group housing project being developed by Godrej Properties in Sector 85, Gurugram.

Lupin gains over 1% on launching first generic version of Oracea

>> The pharma major announced the launch of the first generic version of Oracea (doxycycline capsules 40 mg) in the US.

Paytm falls 3% as PPBL MD & CEO resigns

>> Surinder Chawla, MD and CEO of Paytm Payments Bank has resigned ‘on account of personal reasons’

Broader markets:: SmallCap index trades flat

Sectoral trends:: Private banks see a slight downtick

Sensex Heatmap:: 26 of 30 index stocks rise led by Tata Steel, RIL

Opening Bell:: Nifty tests 22,700

Opening Bell:: Sensex up less than 200 pts

Pre-Open Session:: Nifty holds 22,700

Pre-Open Session:: Sensex gains over 250 pts

Betting big: Mutual funds own a larger slice of small and midcap stocks

Retail investors now own a larger share of smallcap companies than they did a year ago, thanks to their conviction in mutual fund (MF) schemes focused on this segment.

Data from Capitaline shows that MFs’ average holding in the National Stock Exchange Nifty Smallcap 250 Index stood at 9 percent at the end of the October-December quarter of 2023-24 (FY24), up from 7.76 percent in the same quarter of 2022-23.

Gold price climbs Rs 10 to reach Rs 71,740, silver slips to Rs 84,400

The price of 24-carat gold registered a slight uptick of Rs 10 in early trade on Wednesday, with ten grams of the precious metal trading at Rs 71,740, according to the GoodReturns website. The price of silver, on the other hand, went down by Rs 100, with one kilogram of the precious metal selling at Rs 84,400.

The price of 22-carat gold rose Rs 10 with the yellow metal selling at Rs 65,760.

ICICI Bank, Eicher Motors can zoom up to 6-7% says HDFC Securities

Buy Eicher Motors(CMP-4,250): | Target Rs. 4,550 | Stop-loss Rs 4,050

By surpassing the previous swing high of 4,200, the Stock has registered a fresh all-time at 4,303. The primary trend of the stock is bullish, as it has been forming higher tops and higher bottoms on the weekly charts. The auto sector has been outperforming for the last couple of weeks.

Nifty Private Bank nearing correction: Here’s what the charts indicate

Nifty Bank Index

The Nifty Bank Index is currently trading at 48,730.55, exhibiting a bullish short-term trend on the charts. However, in the near term, the index is anticipated to encounter resistance levels, potentially leading to profit booking as the rally progresses.

Stocks to Watch today: Paytm, Maruti, ICICI Lombard, Lupin, PolicyBazaar

Here are the stocks that are expected to be on investors’ radar this Wednesday.

Maruti: The auto major on Tuesday said it has added a new assembly line at its plant in Manesar, Haryana, which has increased the company’s total manufacturing capacity from 2.25 million units to 2.35 million units.

Paytm: Surinder Chawla, MD and CEO of Paytm Payments Bank has resigned ‘on account of personal reasons’, the company said in a regulatory filing yesterday. The resignation would be effective from June 26.

Also Read Best 10 Websites To Watch Tamil Movies Online For Free – High Quality!

Rupee depreciates 2 paise

Brent crude at $89.56 per bbl

Gift Nifty futures suggest a positive start

At 07:15 AM, the Gift Nifty futures were quoting 80 points higher than Nifty 50 futures at 22,815.

Also Read: The message-writing part of Google Messages has been modified!

Asian markets trading lower on Wednesday morning

US indices end flattish

Reader Interactions