Canara Bank Live Share Price: A total of 7,39,996 retail investors owned 6 per cent stake in the bank while 337 HNIs including Rekha Rakesh Jhunjhuwala (1.45 per cent stake) owned a combined 4.65 per cent stake in the PSU lender.

119.50 INR+6.20 (5.47%)today

| Open | 116.25 |

| High | 119.55 |

| Low | 116.00 |

| Mkt cap | 21.70KCr |

| P/E ratio | 1.42 |

| Div yield | 13.47% |

| 52-wk high | 126.58 |

| 52-wk low | 58.27 |

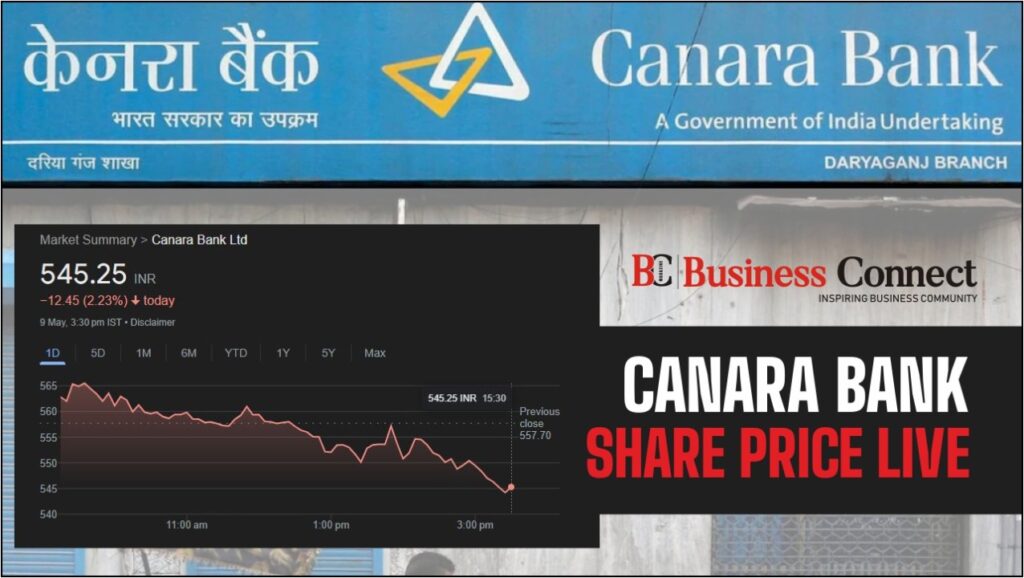

Canara Bank Share Price Today Live Updates: Canara Bank’s stock opened at ₹557.4 and closed at ₹549.15 on the last trading day. The high for the day was ₹568.95, and the low was ₹554. The market capitalization stood at ₹102,725.13 crore. The 52-week high and low were ₹632.65 and ₹291.3, respectively. The BSE volume for the day was 487,986 shares traded.

Canara Bank Share Price Live Updates: Consensus analysts rating is Buy

Canara Bank Share Price Live Updates: The analyst recommendation trend is shown below with the current rating as Buy.

- The median price target is ₹506.0, 325.93% higher than current market price.

- The lowest target price among analyst estimates is ₹360.0

- The highest target price among analyst estimates is ₹670.0

| Ratings | Current | 1 Week Ago | 1 Month Ago | 3 Months Ago |

| Strong Buy | 6 | 6 | 6 | 5 |

| Buy | 3 | 4 | 4 | 5 |

| Hold | 1 | 2 | 2 | 2 |

| Sell | 2 | 2 | 2 | 1 |

| Strong Sell | 2 | 0 | 0 | 0 |

Canara Bank Share Price Today Live: Hourly Price Movement Update

Canara Bank Share Price Today Live: Canara Bank’s stock price reached a peak of 118.85 and a low of 118.15 in the previous trading hour. During that time, the stock price surpassed the hourly resistance of 118.58 (Resistance level 1), suggesting a positive upward trend.

The hourly support and resistance levels to watch out in the next hour are mentioned below.

| Resistance Levels | Price | Support Levels | Price |

|---|---|---|---|

| Resistance 1 | 119.02 | Support 1 | 118.32 |

| Resistance 2 | 119.28 | Support 2 | 117.88 |

| Resistance 3 | 119.72 | Support 3 | 117.62 |

Canara Bank Share Price Live Updates: Simple Moving Average

| Days | Simple Moving Average |

|---|---|

| 5 Days | 111.11 |

| 10 Days | 117.33 |

| 20 Days | 118.44 |

| 50 Days | 116.90 |

| 100 Days | 107.50 |

| 300 Days | 90.39 |

Canara Bank Share Price Live Updates: Canara Bank trading at ₹118.65, up 4.77% from yesterday’s ₹113.25

Canara Bank Share Price Live Updates: Canara Bank share price is at ₹118.65 and has crossed the key daily support price level of ₹543.87. This indicates that stock is experiencing significant selling pressure and the price can decline further.

Earlier this year on April 19, 2024 the public sector lender had set Wednesday, 15th May 2024 as the record date for determining entitlement of equity shareholders for the purpose of split of existing equity shares of the bank. The stock split arrangement was such that 1 equity share having face value of Rs. 10 each, will be subdivided into 5 equity shares having face value of Rs. 2 each.

A stock split makes the shares more affordable for retail investors, and the move is likely to increase trading activity on the counter. This could be particularly beneficial for smaller investors who may have been previously deterred by the higher share price.

Moreover, the stock split has the potential to broaden the bank’s retail investor base. Prior to the split, a significant portion of the bank’s ownership was held by a relatively small number of High Net Worth Individuals (HNIs), including notable investors like Rekha Rakesh Jhunjhunwala.

It’s important to note that a stock split differs from a bonus share issue. In a stock split, existing shares are divided into multiple shares with smaller face values, while in a bonus share issue, additional shares are distributed to existing shareholders based on their current holdings. Therefore, while a stock split increases the number of shares outstanding, it does not directly impact the share capital of the company.

Canara Bank recorded a 18.33 per cent year-on-year growth to Rs 3,757 crore in January-March quarter of fiscal year 2023-24 (Q4FY24). The bank’s net interest income (NII), increased by 11.18 per cent to Rs 9,580 crore during the fourth quarter of FY24. The bank registered NII of Rs 8,617 crore in the same period of the previous year.

At 11:17 AM; the stock of the company was trading 4.55 per cent higher at Rs 118.40 per share. By comparison the S&P BSE Sensex was down mariginally by 0.04 per cent.

Reader Interactions