Prime Minister invited Micron Technology to boost semiconductor manufacturing in India. He noted that India can provide competitive advantages in various parts of the semiconductor supply chain.

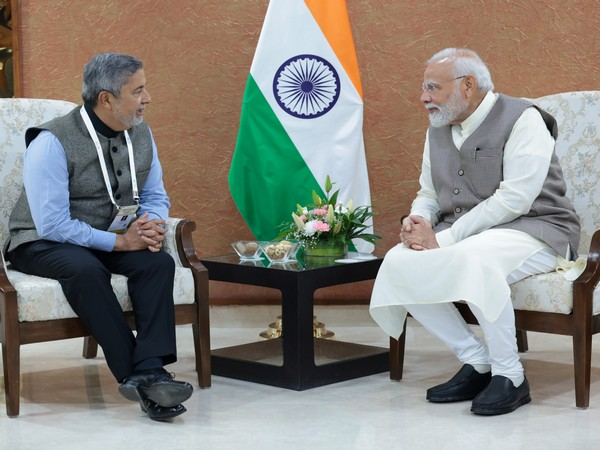

GANDHINAGAR: Sanjay Mehrotra, the President and CEO of Micron Technology, held a meeting with Prime Minister Narendra Modi in Gandhinagar, where they discussed Micron’s efforts to enhance the semiconductor manufacturing ecosystem in India.

“They discussed Micron’s efforts to enhance the semiconductor manufacturing ecosystem in India,” PMO said in an X post.

Speaking after his meeting with PM Modi, CEO of Micron Sanjay Mehrotra said that he had discussed the progress of Micron’s project in Sanand with the

Prime Minister.

“We were pleased to have the opportunity to update Prime Minister Modi on the progress that we are making with our Sanand and project so our meeting was dedicated to that as well as Microns focus on continuing to increase the workforce for semiconductor manufacturing here in India and we also talked about my Micron’s engagement with a social with community here (the Atal Tinkering Lab)” Mehrotra said.

“So these were various topics, very engaging discussion and we really appreciate Prime Minister Modi’s support as well as the Chief Minister support the government support at the state level as well as the central level toward advanced of semiconductor manufacturing” he added.

“I think it’s a great opportunity and India’s time has come in this regard and Micron has taken the pioneering step of starting manufacturing plant here and we hope the ecosystem can follow successfully in this regard” the Micron CEO further said.

During PM Modi’s US State visit last year, the semiconductor manufacturer announced its India investment plans. Micron Technology committed that it will invest up to USD 825 million to build a new semiconductor assembly and test facility in India with support from the Indian government.

Micron had selected Gujarat’s SANAND Industrial Park (Gujarat Industrial Development Corporation – GIDC) due to its manufacturing infrastructure, conducive business environment and firm talent pipeline.

India hopes to become a major global hub in semiconductor manufacturing over the next 10 years.

The semiconductor industry in India is still in a nascent stage, and the central government has been aggressively looking at collaboration with global and domestic players to make further inroads in this crucial sector.

In July last year, Sanjay Mehrotra met PM Modi in Gujarat’s Gandhinagar and they discussed the US-based company’s plans to bolster the semiconductor manufacturing ecosystem within India.

The meeting last year was held during the second edition of Semicon, organized by India Semiconductor Mission in partnership with industry and industry associations, aimed at making India a global hub for semiconductor design, manufacturing and technology development. The first edition of Semicon India was held in Bengaluru the preceding year.

The Vibrant Gujarat Global Summit was initiated by Narendra Modi in 2003, then chief minister, to put Gujarat on the world map of trade and industry. The tenth edition of the Summit will be held from January 10 to 12, 2024. For the smooth conduct of the event, several committees have been formed to look after various aspects of the summit.

This News was officially published on :- timesofindia.indiatimes!

Also Read : Bengaluru CEO kills son: Police reveal how Suchana Seth tried to mislead!