Here is all the information you require prior to the market opening on Tuesday, May 14: Gift Nifty points to a robust beginning; Zomato shares will react to Q4 Earnings; Keep an eye out for these pivotal Bank Nifty and Nifty levels.

Pre-market stock update for May 14, Tuesday:Aided by the sharp intraday rally yesterday, the NSE Nifty 50 managed to survive above the 100-DMA (Daily Moving Average) for the third straight trading session.

The market may look to build-up on the gains, amid supportive cues from Asian peers. The focus, however, will be on the inflation data in India and the US, followed by the US Fed chief Jerome Powell speech.

Retail inflation in India eased to 4.83 per cent in April, even as food prices continued to surge. The data was release on Monday, post market hours.

Akhil Mittal, Senior Fund Manager-Fixed Income, Tata Asset Management said the CPI numbers were in line with expectations, and hence may not have any material impact on policy / markets.

At 07:00 AM, Gift Nifty futures quoted at 22,239, suggesting a mildly positive start on the Nifty 50.

Among individual stocks Zomato will be in focus after the company posted its fourth straight quarterly net profit.

That apart, shares of Archean Chemical, AIA Engineering, Andhra Paper, Apar Industries, Apollo Tyres, Aurionpro Solutions, Bajaj Electricals, BASF India, Bharti Airtel, Bharti Hexacom, BLS International, Butterfly Gandhimathi, Colgate Palmolive, Devyani International, Edelweiss Financial Services, Ganesh Housing Corporation, HP Adhesives, Ideaforge Technology, Jubilant Ingrevia, Kirloskar Brothers, Man Infraconstruction, Mirco Electronics, Oberoi Realty, OnMobile Global, Patanjali Foods, PVR Inox, Radico Khaitan, Shree Cement, Siemens, Thyrocare Technologies and Zydus Wellness will be in focus as these companies announce Q4 results today.

Trading strategy for Tuesday, May 14 – Should you be a buyer or seller today? Here’s what market experts recommend:

Osho Krishan, Sr. Analyst – Technical & Derivative Research at Angel One recommends to remain cautious amidst the rise in volatility, which may be deceptive and could trap traders on either side. He adds that traders should refrain from aggressive overnight bets, and maintain exclusivity with stock selection.

On the level-specific front, Osho expects support for the Nifty around 22,000 – 21,900, followed by the sacrosanct support of the 89-DEMA around 21,800 zone. At the higher end, 22,200-22,300 is likely to act as intermediate resistance, and a sustainable surpass could only trigger a fresh round of longs in the system.

What are Shares and Types of Shares?

Analysing the F&O data, Ashwin Ramani, Derivatives & Technical Analyst of SAMCO Securities, reveals that both the 21,800 & 21,900 Strikes saw strong put writing. The Nifty has formed a hammer pattern on the daily chart, which is considered to be a bullish reversal signal. If call writers (Bears) exit from the 22,000 Strike, then Nifty is likely to move higher.

Echoing similar terms, Om Mehra, Technical Analyst of SAMCO Securities, said the Nifty has formed a hammer candlestick pattern at the support of its rising trendline on the daily chart, signaling a potential reversal.

The Nifty may trade within a broader range of 21,950 to 22,250 in the coming sessions. While the Nifty closed above its 100-day Moving Average (DMA), but needs to close above the crucial level of 22,300, to confirm a bullish stance to continue, Om Mehra added.

Bank Nifty halted its eight-session losing streak, showing resilience as it formed a morning star pattern on the hourly chart and rebound from lower levels, closing the session at 47,754. Currently, Bank Nifty is positioned near a crucial rising trendline. The daily Relative Strength Index (RSI) stands at 46 levels. Immediate resistance remains at 48,000; if crossed, we expect a rally till 48,250-48,300, the analyst concluded in the note.

Similarly, Neeraj Sharma, AVP Technical and Derivatives Research at Asit C. Mehta Investment Intermediates suggested that as per the hammer candlestick pattern, as long as the Nifty holds the support of 21,820, the relief rally will continue. The 21-DEMA is placed near 22,315, which will act as an immediate hurdle for the index. Thus, for the short term, we expect a pullback towards 22,300 levels. If the index sustains above 22,315, the pullback rally might test 22,500 levels.

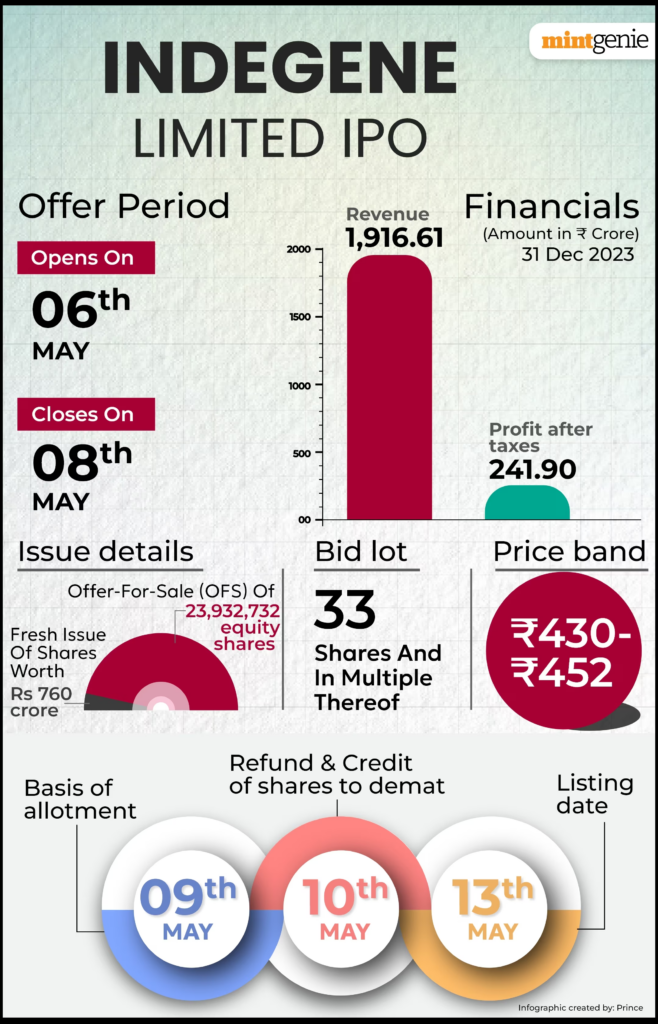

Indegene Share Price Starts Strongly, Opening at ₹655 on NSE with a 45% Premium.

Global markets

Overnight, the US market ended little changed with the Dow Jones snapping its seven-day rally as investors awaited US inflation data and Fed chair Powell speech.

The yield on benchmark the US 10-year notes fell 1.6 basis points to 4.489 per cent.

This morning in Asia, Nikkei and Taiwan gained over 0.5 per cent each. Kospi was flat. The Bank of Japan on Monday sent a hawkish signal to markets by cutting the amount of Japanese government bonds it offered to buy in a regular operation.