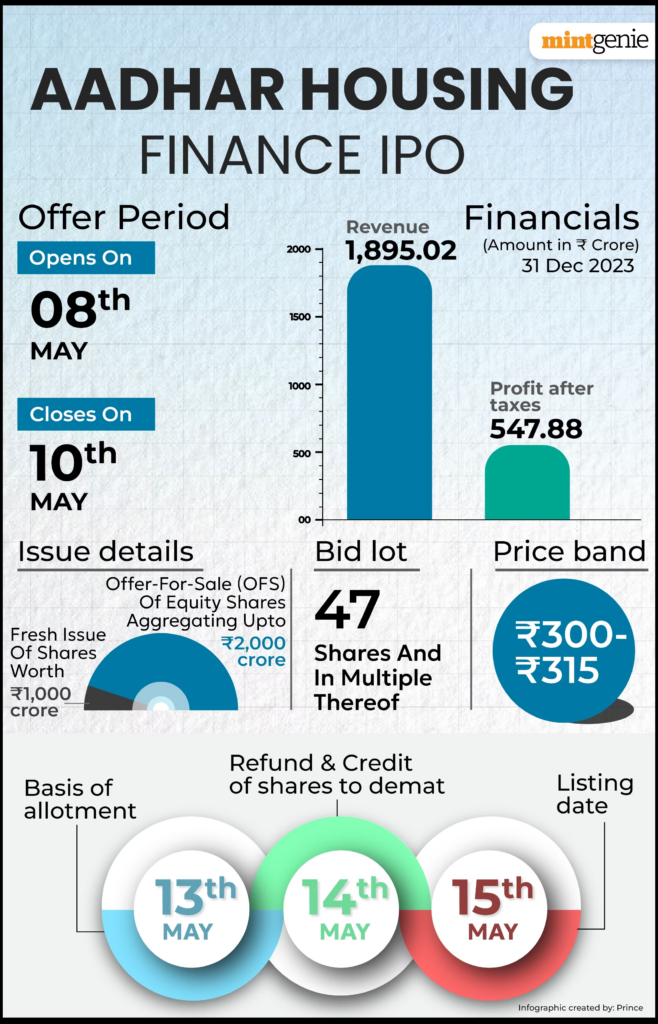

Aadhar Housing Finance IPO opens on May 8 and closes on May 10 with a price band of ₹300 to ₹315 per share. The company raised ₹898 crore from anchor investors. Retail investors get a 35% allocation while employees receive a discount of ₹23 per share.

Aadhar Housing Finance IPO opens for subscription today (Wednesday, May 8), and will end on Friday, May 10. The IPO price band for the Blackstone-backed business is set at ₹300 to ₹315 per share. Aadhar Housing Finance IPO raised ₹898 crore from anchor investors on Tuesday, May 7. Bids can be placed for multiples of 47 shares, with a minimum bid of 47.

Aadhar Housing Finance IPO has allocated retail investors 35% of the issue size, non-institutional investors (NIIs) 15%, and qualified institutional buyers (QIBs) 50% of the issue size. The company is offering a discount of ₹23 per share to its employees.

Aadhar Housing Finance Limited is a housing finance firm that was founded in 2010 with an emphasis on lower-income groups.

Customers in India’s tier 4 and tier 5 towns are the target market for the sales offices of the deep impact branches.

The firm enlisted 12,221 Aadhar Mitras as of September 30, 2023, who are paid referral fees for finding loans for their clients.

The organization offers a range of mortgage financing options for building, renovating, and buying residential and commercial real estate.

The corporation has an extensive network of 471 branches, including 91 sales offices, as of September 30, 2023. These branches and sales offices serve about 10,926 pin codes in India and are dispersed over 20 states and union territories.

As per the Red herring prospectus (RHP), Aadhar Housing Finance’s listed peers are Aptus Value Housing Finance India Ltd (with a P/E of 31.3), Aavas Financiers Ltd (with a P/E of 28.1), Home First Finance Company India Ltd (with a P/E of 34.9), and India Shelter Finance Corporation Ltd (with a P/E of 33.1).

Between March 31, 2022, and March 31, 2023, Aadhar Housing Finance Limited’s profit after tax (PAT) climbed by 22.22% while its revenue increased by 18.22%.

Today, Narendra Modi will speak at a public gathering and conduct a roadshow in Andhra.

Glow by Kirtilals Shines Bright with Grand Opening of Thrissur Showroom

Aadhar Housing Finance IPO details

Aadhar Housing Finance’s ₹3,000 crore initial public offering consists of an OFS (offer for sale) by promoter BCP Topco VII Pte Ltd, a Blackstone Group affiliate, for ₹2,000 crore and a fresh issue of equity shares valued at ₹1,000 crore.

Promoter BCP Topco VII Pte will sell its interest within the OFS. 98.7% of the pre-offer issued, subscribed, and paid-up equity share capital is now held by BCP Topco, the promoter and an affiliate of funds managed by Blackstone.

The company plans to use the net proceeds for general corporate activities and to meet future capital requirements for further lending.

The book-running lead managers are SBI Capital Markets Limited, Nomura Financial Advisory and Securities (India) Pvt Ltd, Kotak Mahindra Capital Company Limited, ICICI Securities Limited, and Citigroup Global Markets India Private Limited. For this issuance, Kfin Technologies Limited is acting as registrar.

Aadhar Housing Finance IPO Review

BP Equities Pvt Ltd

The brokerage claims that the company and management team’s capabilities are demonstrated by the overall growth, portfolio performance, asset quality, and sustained profitability during these times. Aavas Financiers (14.1%) and Home First Finance (13.5%) were the next two financial companies with the greatest return on equity in FY23, with Aadhar Housing Finance reporting the second-highest rate at 15.9%. Among the peers analyzed, it also claimed the third lowest personnel cost over the same time, at 2.10% in FY23. Aadhar Housing Finance, one of the peer sets under analysis, reported annualized yield on advance and return on equity for the nine months ending December 31, 2023, at 14.2% and 18.4%, respectively.

The brokerage said that as time goes on, it anticipates improved operational performance, driven mostly by the low-income housing segment’s dominance, cheap borrowing costs, and greater peer return ratios. The stock is priced at 3.1x P/BVPS on FY23 book value at a higher price range of Rs. 315, which they believe is reasonable in comparison to its rivals. As a result, the brokerage suggests giving the issue a SUBSCRIBE rating.

Swastika Investmart Ltd

The brokerage claims that there are a few significant obstacles that need to be carefully considered. Because of the creditworthiness of its low-income customers and the rise of non-performing assets (NPAs), Aadhar is exposed to inherent risks. In addition, the firm faces volatility in loan rates and competes in a highly competitive field.

Although Aadhar’s IPO value of 22.8x P/E and 3.36x P/BV seems reasonable, caution is necessary due to the company’s significant reliance on borrowing. As a result, the brokerage only advises high-risk investors looking for sustained exposure to the affordable housing market to consider this IPO.

Sanju Samson pays the price for a heated argument with on-field umpires as BCCI slaps heavy penalty on RR captain

Aadhar Housing Finance IPO GMP today

Aadhar Housing Finance IPO GMP is +70. This indicates that Aadhar Housing Finance share price was trading at a premium of ₹70 in the grey market, according to investorgain.com.

When the upper end of the IPO pricing range and the present premium on the grey market are taken into consideration, it is projected that Aadhar Housing Finance shares will list at a price of ₹385 a share, which is 22.22% more than the IPO price of ₹315.

‘Grey market premium’ indicates investors’ readiness to pay more than the issue price.