HUDCO shares have increased by 141% in 2023. This became the company’s second consecutive year of positive returns in a calendar year; in 2022, it had also gained 34%.

At a record high of ₹233.85 on Friday, shares of Housing & Urban Development Corporation Ltd. (HUDCO) increased by as much as 15%. On Friday, the stock increased for the sixth session in a row.

HUDCO shares Market Live

| Company | Value | Change | %Change |

|---|---|---|---|

| Tech Mahindra | 1,280.50 | ₹90.20 | 7.58 |

| Divis Labs | 4,032.60 | ₹188.80 | 4.91 |

| LTIMindtree | 4,790.90 | ₹156.20 | 3.37 |

| Bajaj Auto | 8,951.35 | ₹216.45 | 2.48 |

| BPCL | 610.20 | ₹6.80 | 1.13 |

Other Indices

| Index | Value | Change | %Change |

|---|---|---|---|

| SENSEX | 73,896.41 | -443.03 | -0.60 |

| NIFTY 50 | 22,452.50 | -117.85 | -0.52 |

| NIFTY Midcap 100 | 50,637.40 | 408.90 | 0.81 |

| NIFTY Smallcap 100 | 16,979.25 | 92.45 | 0.55 |

| NIFTY NEXT 50 | 64,147.90 | 443.45 | 0.70 |

Global Indices

| Name | Index Value | Change | %Change | Open | High | Low |

|---|---|---|---|---|---|---|

| DAXApr 26 | 18057.61 | 140.33 | 0.78 | 17920.73 | 18060.49 | 17920.73 |

| Hang SengApr 26 | 17651.15 | 366.61 | 2.08 | 17336.20 | 17758.24 | 17336.20 |

| Taiwan WeightedApr 26 | 20120.51 | 263.09 | 1.31 | 20094.17 | 20226.29 | 20087.61 |

| NasdaqApr 25 | 15611.76 | -100.99 | -0.65 | 15375.26 | 15644.51 | 15343.91 |

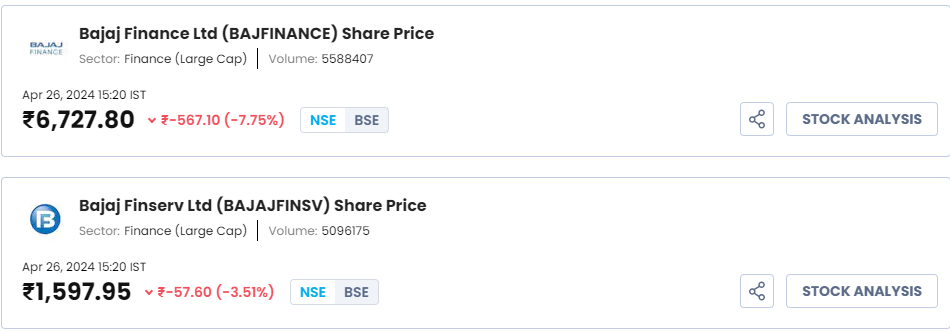

Share price of Bajaj Finance and Bajaj Finserv fell 8% today; here’s why.

With today’s surge, the state-run company has gained nearly 20% this week and is likely to post its best week since January this year.

HUDCO has had a strong start to 2024. The stock is up 24% in April, followed by an 11% advance in February and a 37% gain in January. The stock had declined 2% in March. On a year-to-date basis, the stock is up nearly 80%.

Shares of HUDCO had gained 141% in the calendar year 2023. This was the second straight year of positive returns in a calendar year for the company, having gained 34% in 2022 as well.

Based on the charts, the Relative Strength Index (RSI), which is currently at 73, indicates that the stock has entered overbought territory. When the RSI exceeds 70, it indicates that the stock has reached the “overbought” zone.

Strong volumes have also contributed to Friday’s advances. Compared to the 20-day average of 76 lakh shares, about 8.1 crore shares of the company had already been traded.

RRB release link for examination fees refund: Check bank details update link and last date here.

HUDCO’s net profit for the December quarter increased to ₹519.2 crore, more than double. Additionally, revenue climbed by 18% for the quarter, reaching ₹2,012.66 crore. By the conclusion of the December quarter of the previous year, gross non-performing assets (NPA) had dropped to 3.14% from 4.27%.

The share price of HUDCO has increased 371% in the last twelve months. The Indian government also recently bestowed a “Navratna” classification upon the stock. The stock’s market capitalization, which is currently at ₹46,454 crore, has increased to around ₹50,000 crores as a result of this jump.