On April 25, Mukesh Ambani’s company is going to launch a new ad-free package. During the IPL 2024 matches, JioCinema has already begun to tease the new subscription plan.

Mukesh Ambani, whose enormous net worth of Rs 971002 crore makes him the richest person in India. In addition to being the chairman of Reliance Industries, the most valuable company in India with a market valuation of Rs 1995000 crore, he is the owner of Reliance Jio, the largest telecom operator in the country. By spending Rs 23,758 crore, Mukesh Ambani’s JioCinema was able to win the rights to watch IPL games online for five years. This amounts to an annual total of Rs 4,750 crore. IPL 2024 is now available for free viewing on JioCinema, and part of the platform’s content is accessible without a membership. Even though IPL 2024 streaming is free, there are frequently a ton of advertisements in front of the screen.

Mukesh Ambani’s company intends to launch a new ad-free package on April 25 as viewers grow accustomed to watching OTT videos without advertisements. During the IPL 2024 matches, JioCinema has already begun to tease the new subscription plan.

Although things change constantly, your plan doesn’t have to. A fresh scheme. upcoming on April 25. The official JioCinema account on X was teased. Through a variety of creatives, the business is also hinting at a new ad-free membership package. At the moment, JioCinema charges Rs 999 for an annual subscription plan, and consumers may alternatively purchase a Rs 99 monthly plan.

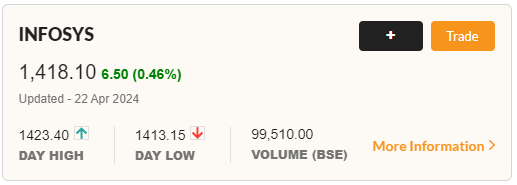

Infosys share price Today Live Updates: Infosys stock Price is increasing: trading strongly today.

A sizeable portion of the Rs 4,000 crore in IPL advertising revenue is used to fund the free IPL streaming. With cheaper ad rates offered by Amabni’s JioCinema, more advertisers will be present for a longer period. In addition to advertising, Mukesh Ambani receives payment for data usage. Jio, owned by Mukesh Ambani, is the biggest telecom provider in the nation. Ambani’s Jio makes more money when more people watch the IPL online. Ahead of the 2024 Indian Premier League, Reliance Jio even unveiled customized plans designed to make it simpler for customers to enjoy hassle-free viewing.