A number of mobile retail chains have declared that they will no longer be selling OnePlus smartphones as of May 1st, citing unresolved difficulties with the brand. The business told India Today that it is collaborating with its partners to find solutions to the problems related to retail chains.

A number of mobile retail chains have declared that they will no longer be selling OnePlus smartphones as of May 1st, citing unresolved difficulties with the brand. OnePlus, a company well-known for its premium devices and devoted following of users, is devastated by this decision. India is one of the brand’s main markets, so losing there will be detrimental to the company.

Counterpoint recently pointed out that OnePlus expanded by 33% year over year in 2023, with offline expansion being one of the main drivers of that growth. The business told India Today that it is collaborating with its partners to find solutions to the problems related to retail chains.

“Over the past seven years, OnePlus has appreciated all of the assistance it has gotten from its reliable retail partners. In order to maintain our commitment to a solid and successful partnership moving forward, we are now working with our partners to resolve the issues mentioned,” a OnePlus spokesperson told India Today.

According to Money Control, the action taken by mobile shop chains stems from persistent disagreements and complaints that have not been settled between the retailers and OnePlus. The parties concerned have attempted to resolve these concerns, but have not been able to do so to a satisfactory degree, which is why the sales have been abruptly stopped.

Read More : Lava launches New Smartphone with 128GB storage, 6.5-inch display!

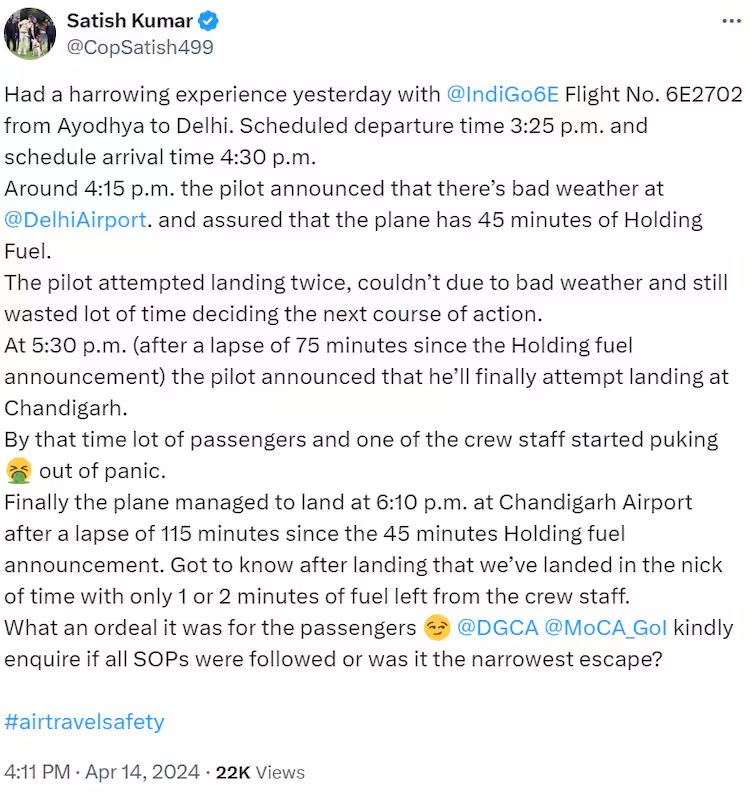

“We have faced major challenges in selling OnePlus products over the last year, which have not yet been addressed. We had anticipated for a more productive partnership with OnePlus as recognized partners. In a letter dated April 10 to Ranjeet Singh, the director of sales of OnePlus India, Sridhar TS, president of the South Indian Organised Retailers Association (ORA), stated, “Unfortunately, the ongoing issues have left us with no alternative but to discontinue the sale of your products in our stores.”

The absence of prompt support and assistance from OnePlus in handling consumer complaints and service-related issues is one of the main grievances raised by the retail chains. This has negatively impacted OnePlus devices’ reputation in the market and overall sales by causing unhappiness among both merchants and customers.

Read More: From Vivo V30 Pro to Xiaomi 14: Upcoming smartphones expected to launch in March 2024