Currency markets are in a deep freeze investors and traders in London think that a very close US election and a globally major interest rate cut will get the global currency markets going again after a break of almost four years.

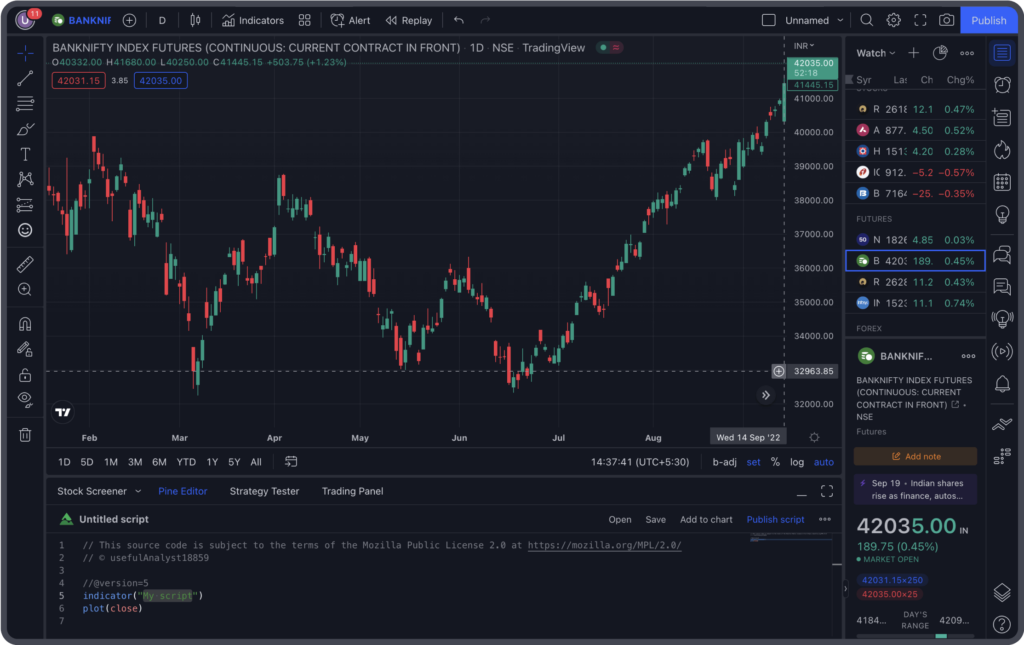

These past and present signs of projected volatility have gone down over the last few months. Volatility is the amount of price change over a certain time frame.

Speculators in foreign exchange can’t profit from the profitable divergent trends in regional bond rates because of the way the world’s largest central banks hold their money.

Deutsche Bank closely monitors the implied currency volatility indicator, which is nearing its lowest point in nearly two years and is not far from pre-pandemic levels.

“The music has not been playing in FX thus far this year,” said Andreas Koenig, director of global FX at the largest asset manager in Europe, Amundi. “U.S. (bond market) rates go up and down, but the others all follow, and therefore we have no change in differentials.”

“Simon cuts first, and to what extent…””Thereafter, the U.S. elections will be the major macro events, the FX events,” predicts Koenig.

A slow process is being used to bring back central banks. In March, the Swiss National Bank was the first major central bank of the cycle to lower the cost of borrowing money. It is expected that later this year, the European Central Bank, the Federal Reserve, and the Bank of England will all take similar steps.

In recent times, there has been a decline in investor wagers regarding Fed rate cuts due to data that has exceeded expectations. In contrast, labor yields in the United States have exhibited an upward trend. On the other hand, bond yields in the euro zone have largely mirrored this trend.

“More differences between central banks would lead to real volatility,” said Samuel Zief, who is in charge of global FX strategy at JPMorgan Private Bank. Instead, he insisted that such volatility was not likely to happen in the first six months of the year, since inflationary trends in the US and Europe were similar.

TRUMP CARD

Donald Trump, who hinted at the prospect of a 10% universal import tariff last year and added in February that, should he reclaim the White House, he could impose tariffs of 60% or more on Chinese commodities, also loomed large.

Click Here to Read : Donald Trump (45th U.S. President) Biography

“Tariffs and additional taxes could cause the dollar to strengthen,” Themos Fiotakis, global director of FX strategy at Barclays, added. He added that the euro and the Chinese renminbi would almost certainly suffer as well.

Barclays estimates that tariffs could increase the value of the currency by 3% in the event that Trump is re-elected. Furthermore, the bank has predicted that parity could potentially be attained between the euro and the U.S. dollar.

Presently, Joe Biden and Donald Trump are unable to reach a consensus, which suggests that the daily global currency market volatility of $7.5 trillion will increase as a result of divergent opinion surveys preceding the November election.

Oliver Brennan, an FX volatility strategist at BNP Paribas, explains that traders are positioning themselves for potential volatility in the yuan, Polish zloty, and Mexican peso—all of which witnessed declines subsequent to Trump’s 2016 victory—via options, which enable investors to place bets on currency prices.

“Volatility in the 9-month to one-year range (for those three currencies) is really high, and because nothing is happening now, volatility is really low,” he pointed out.

“If you look at any currency there is a kink around the November election, but the kink is huge in those three.”

Not Worth Trading

The present decrease in volatility is constraining the range of opportunities that are accessible.

Currency markets are in a deep freeze “Due to current risk profile, currency is allocated significantly less than the long-term average,” said senior portfolio manager Jamie Niven of Candriam.

This assertion holds true in particular in relation to specific currency pairings. “It is not worthwhile to trade euro-sterling at this time,” noted Yusuke Miyairi, a strategist at Nomura. Since 2006, volatility in the pair has been at its lowest.

However, indications are growing that areas of high volatility are starting to manifest due to fluctuations in interest rates.

In spite of the Bank of Japan’s March rate hike, the yen plummeted to its lowest level since 1990 due to traders’ expectation that Japanese financing costs would remain close to zero.

As stated by strategists, this resulted in currency fluctuations throughout Asia, including the Chinese yuan, demonstrating how developments in one region can have repercussions on the entire market.

Additional currency support might be attainable through direct intervention by the government of Japan.

Since the inception of the common currency, the euro recorded its largest quarterly gain against the franc in Europe as a consequence of Switzerland’s rate reduction.

As a result, investors are utilizing all available resources and capabilities.

Carry trade strategies are particularly attractive to Guillaume Rigeade, co-head of fixed income at Carmignac, during periods of low volatility. Carry transactions involve investors borrowing in a currency with low interest rates in order to acquire a currency with a higher yield.

Furthermore, he asserted that when volatility is minimal, the cost of hedging an equity or bond portfolio is reduced.

Zief, an employee of JPMorgan, has not had more promising prospects. “At least we have an environment with carry trades despite the fact that volatility is low,” he contends. “Low volatility with very low rates…is even worse.”

This article is originally Published by Aol News

Also Read : BJP Wants Resignation Of Kejriwal To Stop Free Water And Electricity: AAP MP Sanjay Singh

Reader Interactions