Axis Bank Q4 Results: Compared to ₹11,742 crore in the same time last year, the private sector lender’s net interest income—the difference between interest collected and paid—rose 11.5% year over year to ₹13,089 crore.

Axis Bank Q4 Results: On Wednesday, April 24, Axis Bank released its January–March quarter results for fiscal 2023–24 (Q4FY24). The bank reported a net profit of ₹7,130 crore, up from a loss of ₹5,728.4 crore during the same period the previous year. Net interest income (NII), which is the difference between interest collected and paid, for private sector lenders increased 11.5% YoY to ₹13,089 crore from ₹11,742 crore in the same period last year.

“Axis Bank mapped out a path of consistent advancement in FY24. We persisted in concentrating on Bharat Banking, Digital, and Sparsh as our top priorities, but we were also quick to seize some exciting new opportunities that presented themselves. “We are approaching the last milestone in the next six months, and our integration with Citi is moving along as planned,” stated Amitabh Chaudhry, MD & CEO of Axis Bank.

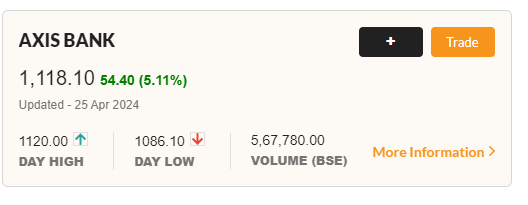

Axis Bank Share Price Today Live Updates: Gains in Axis Bank Stock During Today Trade.

Here are 5 key highlights of Axis Bank’s Q4 scorecard:

P&L Account: Net profit, operating profit

Axis Bank’s operating profit for the quarter stood at ₹10,536 crore, rising 15 percent YoY. The core operating profit for the March quarter came in at ₹9,515 crore, rising five percent YoY. The net profit stood at ₹7,130 crore in Q4FY24, compared to a net loss of ₹5,728 crore in Q4FY23, and grew 17 percent quarter-on-quarter (QoQ). The bank’s net interest margin (NIM) for Q4FY24 stood at 4.06 percent and grew five bps QoQ.

Dividend

The private sector lender’s board recommended a dividend of Re 1 per equity share for FY24. ‘’The Board of Directors has recommended a dividend of Re 1 per equity share of face value of ₹2 per equity share for the year ended 31st March 2024. This would be subject to approval by the shareholders at the next annual general meeting,” said Axis Bank in its regulatory filing to the stock exchanges.

Asset Quality

As of March 31, 2024, Axis Bank’s reported gross nonperforming assets (NPA) and net NPA levels were 1.43 percent and 0.31 percent respectively as against 1.58 percent and 0.36 percent as on December 31, 2023. Recoveries from written-off accounts for the quarter was ₹919 crore.

Reported net slippages in the quarter adjusted for recoveries from the written off pool was ₹398 crore. Gross slippages during the quarter were ₹3,471 crore, compared to ₹3,715 crore in Q3FY24 and ₹3,375 crore in the year-ago period. Recoveries and upgrades from NPAs during the quarter were ₹2,155 crore. The bank in the quarter wrote off NPAs aggregating ₹2,082 crore.

Provisions and contingencies

As of March 31, 2024, the bank’s provision coverage, as a proportion of Gross NPAs stood at 79 percent, compared to 81 percent in the year-ago period. Provision and contingencies for Q4FY24 stood at ₹1,185 crore. Specific loan loss provisions for Q4FY24 stood at ₹832 crores. The bank has not utilized Covid provisions during the quarter and these are reclassified to other provisions. The bank holds cumulative provisions (standard + additional other than NPA) of ₹12,134 crore at the end of Q4FY24.

Other income

Other income fee income for Q4FY24 grew 23 percent YoY and nine percent QoQ to ₹5,637 crore. Retail fees grew 33 percent YOY and 12 percent QoQ and constituted 74 percent of the bank’s total fee income. Retail cards and payments fees grew 39 percent YoY and four percent QoQ. Retail Assets (excluding cards and payments) fee grew 20 percent YoY. Fees from third-party products grew 59 percent YoY and 44 percent QoQ. The corporate and commercial banking fees together grew two percent YoY to ₹1,478 crore.

Other key announcements

Axis Bank’s balance sheet grew 12 percent YoY and stood at ₹14,77,209 crore as of March 31, 2024. The total deposits grew 13 percent YoY and six percent QoQ on period end basis, of which savings account deposits grew two percent YoY and four percent QoQ and current account deposits grew five percent YoY and 18 percent QoQ.

The total term deposits grew 22 percent YoY and five percent QoQ of which retail term deposits grew 17 percent YoY and five percent QoQ. The share of CASA deposits in total deposits stood at 43 percent. The bank’s advances grew 14 percent YoY and four percent QoQ to ₹9,65,068 crore as of March 31, 2024.