Share price of Bajaj Finance: The non-banking financial firm predicted that its assets under management will increase by 26% to 28% in the fiscal year that began on April 1, 2024, as opposed to 34% growth in the year prior.

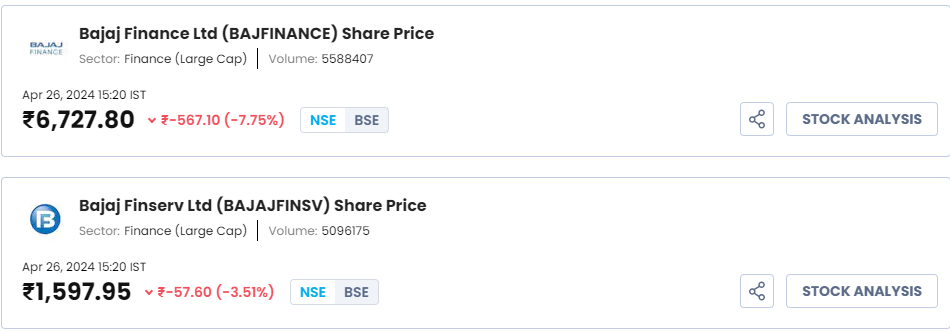

Friday’s trading saw a dramatic decline in Bajaj Finance Ltd. shares due to worries over the shadow lender’s growing profits. The stock fell 7.78% from its previous closing of Rs 7,293.90 to a day low of Rs 6,728.

In contrast to the previous year’s 34% growth, the non-banking financial organization predicted that its assets under management would expand by between 26% and 28% in the fiscal year that began on April 1, 2024. Over the next two quarters, the NBFC predicted that its net interest margin would decrease by 30 to 40 basis points (bps).

PM Narendra Modi reacts to SC’s VVPAT verdict and claims Congress has Muslim quota plan in Bihar

Although Bajaj Finance reported a 21% increase in fourth-quarter (Q4 FY24) earnings, it stated that it was “cautiously optimistic” about the potential for additional “rear-ended” profit growth in fiscal year 2025.

Bajaj Finance also caused a roughly 4% decline in the share price of its parent firm, Bajaj Finserv Ltd., through what is known as a “rub-off effect.”

How much did Yodha earn?, to be shown in OTT as well.

Brokerage views

Brokerage Emkay stated that despite the Reserve Bank of India’s (RBI) prohibition on EMI and e-com cards, which reduced PBT by about 4%, Bajaj Finance posted a strong set of results in Q4 FY24.

“In general, we observe that the company is making good progress toward its long-term strategy goals. We modestly adjust our forecasts to reflect the Q4 developments and management guidance, which will result in a 3–1% PAT change in FY25E–27E. We maintain our ‘Buy’ rating and our unchanged Mar-25E target price of Rs 9,000 per share, the statement continued.

The secured lending segment led the NBFC’s solid rise in AUM (Asset Under Management), according to Religare Broking, while margin continued to decline.

“The increase in cost of funds by 10bps QoQ/47bps YoY to 7.9 percent was the primary cause of the drop in margin. In light of the company’s growing percentage of secured loans in its portfolio, the management anticipates that the margin may fall by 30 to 40 basis points (bps) by H1 FY25.

“The management is waiting for the RBI to lift the card restrictions and anticipates that the credit quality will remain stable. In terms of finances, we project NII/PPOP/PAT to increase at a CAGR of 26%/24%/25% during FY24–26E. We retain our buy recommendation for Bajaj Finance with a target price of Rs 8,861, as we are still bullish on the company,” Religare stated.