Indegene share price opened at ₹655 per share, 44.9% higher than the issue price of ₹452, on NSE. Indegene IPO includes an OFS of 23,932,732 equity shares and a fresh issue of ₹760 crore, totaling ₹1,841.76 crore. Market experts predicted shares to list between ₹740 to ₹760.

Indegene share price made a stellar debut on the bourses today. On NSE, Indegene’s share price opened at ₹655 per share, 44.9% higher than the issue price of ₹452. On BSE, Indegene’s share price today opened at ₹659.70 apiece, up 45.95% from the issue price.

Market experts anticipated the Indegene share price to open in the range of ₹740 to ₹760 per share.

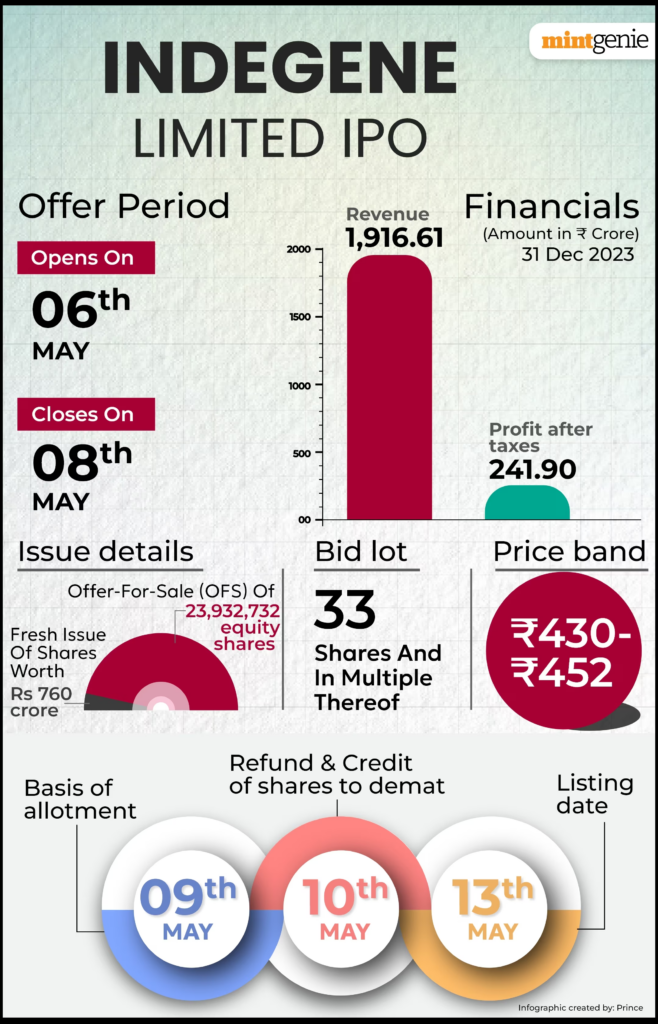

On the last day of bidding on Wednesday, May 8, the initial public offering of healthcare technology business Indegene was subscribed 69.71 times. Qualified Institutional Buyers (QIBs) subscribed 197.55 times, while non-institutional investors subscribed 54.75 times. The quota for retail individual investors garnered 7.68 times as many subscribers.

The subscription period for the Indegene IPO commenced on Monday, May 6. The price band for each equity share with a face value of ₹2 was ₹430 to ₹452. On Friday, May 3, the Indegene IPO picked up ₹548.77 crore from 36 anchor investors at an upper price range of ₹452 per equity share.

Indegene Limited offers digital services to the life science business. They work on medication development, clinical trials, regulatory filings, pharmacovigilance, complaint handling, and sales/marketing assistance.

Tata Motors Share Price Tanks 9% after Q4 Results 2024. Opportunity to buy?

Indegene IPO details

An offer-for-sale (OFS) of 23,932,732 equity shares by the investor selling shareholder and a fresh issue of ₹760 crore make up the ₹1,841.76 crore Indegene IPO.

The following parties are selling their holdings: Ltd.; BPC Genesis Fund I SPV (up to 2,657,687 equity shares); Manish Gupta (up to 1,118,596 equity shares); Vida Trustees Private Limited (up to 3,600,000 equity shares); Dr. Rajesh Bhaskaran Nair (up to 3,233,818 equity shares); Anita Nair (up to 1,151,454 equity shares); and CA Dawn Investments (up to 10,792,650 equity shares).

The proceeds of the fresh issue will be used by the company to finance inorganic growth, general corporate purposes, capital expenditure requirements for both the company and one of its material subsidiaries, Indegene, Inc., as well as the repayment or prepayment of ILSL Holdings, Inc’s debt.

The Indigene IPO’s book-running lead managers are Nomura Financial Advisory And Securities (India) Pvt Ltd, Citigroup Global Markets India Private Limited, J.P. Morgan India Private Limited, and Kotak Mahindra Capital Company Limited. Link Intime India Private Ltd. serves as the issue’s registrar.

Indegene IPO GMP today

Indegene IPO GMP or grey market premium is +307. This indicates that Indegene IPO share price was trading at a premium of ₹307 in the grey market, according to investorgain.com.

After taking into consideration the upper end of the IPO pricing range and the existing premium on the grey market, it is expected that Indegene shares will list at a price of ₹759 per share, which is 67.92% more than the IPO price of ₹452.

According to investorgain.com, based on the past 17 sessions of grey market activity, today’s IPO GMP trends are higher, indicating a positive listing. The lowest GMP is ₹160, while the highest GMP is ₹307.

‘Grey market premium’ indicates investors’ readiness to pay more than the issue price.