Anchor investors have committed more than Rs 8,200 crore in equity to Vodafone, which is seeking to raise Rs 45,000 crore in debt and equity. Growth capex will be the primary use of the funds.

According to sources who spoke with Moneycontrol, Vodafone Idea (Vi) is getting ready to conduct a follow-on public offer (FPO) to raise between Rs 18,000 and Rs 20,000 crore by the middle of the following week.

As lead managers for the FPO—the biggest offers of its kind in India—the indebted telecoms operator has brought on Jefferies, SBI Caps, and Axis Capital. However, according to insiders, none of the banks are financing the project.

As of right now, the largest share sale in the Indian market has been Yes Bank’s Rs 15,000 crore FPO.

Adani Enterprises’ Rs 20,000-crore FPO in January 2023 was expected to surpass it, but the Gautam Adani flagship business canceled the offer after the Adani group was accused of multiple governance violations in a Hindenburg Research report.

According to sources, Vodafone Idea has received commitments from institutional investors, both domestic and overseas, indicating early support for the FPO.

According to sources, the government of India, which owns 33% of the company’s shares, supports the fundraising. However, some investors contacted the government before investing in the FPO.

Jefferies and Axis Capital declined to comment, while emails submitted to Vi and SBI Capital were not returned.

The decision was made amid financial difficulties and fierce competition in the telecom industry.

Due to a substantial debt load and operating losses that have been made worse by regulatory concerns, Vodafone Idea’s subscriber base and market share have been declining.

The preferential allotment of shares valued at Rs 2,075 crore to Oriana Investments Pte Ltd, a member of the promoter group and an Aditya Birla Group subsidiary, was approved by the Vodafone Idea board on April 5.

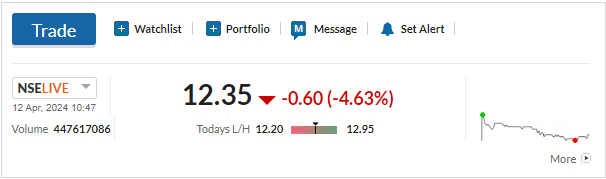

The issue price is Rs 14.87, which is more than the BSE’s closing price on Friday of Rs 13.36.

It is anticipated that the offering’s profits will give the business much-needed support and cash.

Telecom Regulatory Authority of India (TRAI) data shows that in February, Vodafone Idea’s customer base decreased by 1 million, to 220.5 million. Due to customers switching to alternative service providers, the telco has been losing two to six million customers every quarter for the past few quarters. As of December 31, there were 215.2 million users of Vodafone Idea worldwide.

According to industry experts, to maintain subscriber retention and raise service quality, the telco must make immediate infrastructural investments.

The Vodafone Idea stock was down about 2 percent from the previous closing at 11.48 p.m. on the National Stock Exchange, trading at Rs 12.65.