Sensex Today Live Updates: On April 8, provisional data from the NSE revealed that domestic institutional investors (DIIs) purchased ₹3,470.54 crore worth of stocks, while foreign institutional investors (FIIs) net sold shares worth ₹684.68 crore.

Sensex Live Updates for Today: Ahead of this week’s U.S. inflation report and a significant meeting of the European Central Bank, global stocks were neutral on Tuesday. Meanwhile, industrial metals prices continued their current upward trend, supported by prospects of a global manufacturing comeback.

Early trading saw a 0.1% decline in the pan-European STOXX 600 index, despite muted Wall Street futures.

According to Dan Boardman-Weston, CIO at BRI Wealth Management, “stock markets seem to be in a holding pattern at the moment and I think that will continue until we get more clarity on inflation and the state of the economy.”

“Markets are waiting to see what the inflation print is and how that changes expectations for rate cuts going forward.” This year, expectations for rate decreases in the US have decreased due to strong economic statistics and persistent inflation readings.

Instead of the 150 basis points (bps) that traders were pricing in at the beginning of the year, they are now pricing in about 62 bps of cuts from the Federal Reserve in 2024, which implies a two or three-quarter-point reduction.

Similar events are taking place in Europe, where investors will be closely examining President Christine Lagarde’s remarks ahead of Thursday’s ECB policy statement, hoping to find any indications that rates may be lowered in June.

As shares in the Asia-Pacific region increased, industrial metals prices continued to rise on Tuesday amid hopes of a global manufacturing resurgence.

The Asia-Pacific equities MSCI broadest index outside of Japan had a 0.6% increase. Nikkei 225 in Japan gained 1.1%.

The most traded May copper futures in Shanghai reached a record high, rising more than 1%, while the metals zinc and tin reached multi-month highs and aluminum closed just below the two-year high set on Monday. Despite being hit hard by China’s real estate slump, iron ore prices in Singapore remained above $100 per tonne.

According to Vishnu Varathan, head of economics at Mizuho Bank in Singapore, “It’s pretty much a China bet.”

According to figures released on Monday, German industrial production increased in February more than anticipated. Data from last week indicated that American manufacturing was expanding for the first time in a year and a half. In March, China’s manufacturing output increased for the first time in six months.

According to BRI’s Boardman-Weston, central bank purchases and increased geopolitical concerns helped spot gold reach yet another record high. “I think the rally may continue in the short term,” he stated.

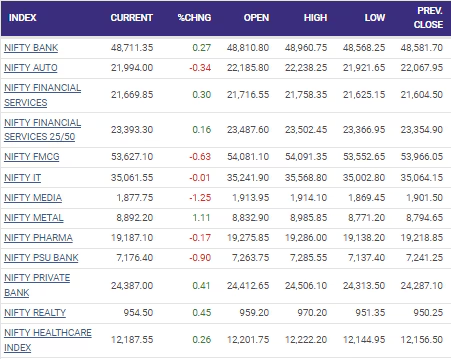

Sensex Today Live: Sector Indices Heat Map

Sensex Today Live: Across sectors, the Media and PSU Bank were the biggest losers, both down 1.25%, and 0.90%, respectively. Following them were the Consumer durables, FMCG, Oil & Gas, Auto, and Pharma indices, which were down 0.81%, 0.63%, 0.46%, 0.34%, and 0.17%.

Among the gainers were Metal, up 1.11%, followed by Financial Services, and Bank, which were up 0.30%, and 0.27%.

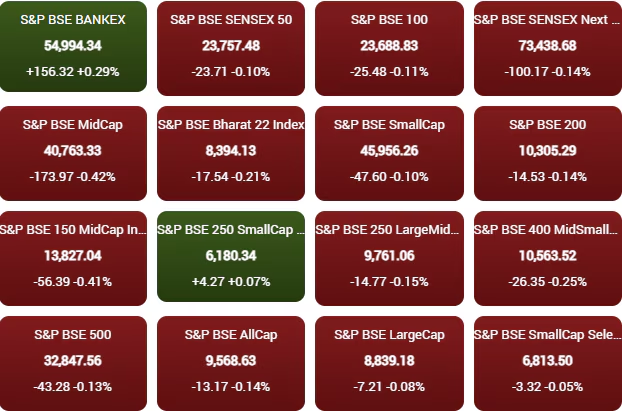

Sensex Today Live: Broader market indices heat map

Sensex Today Live: Having shed their earlier gains, the broader market was in the red, with the BSE MidCap index down 0.42%, and the BSE SmallCap index down 0.10%.

Sensex Today Live: Gainers and Losers on Nifty

Sensex Today Live: 30 of the 50 stocks on the Nifty 50 were in the red, with Titan, Coal India, Reliance Industries, Hero MotoCorp, and Tech Mahindra, emerging as the top losers of the day, while Apollo Hospital Enterprises, Hindalco, ICICI Bank, Bajaj Finserv, and Infosys, were the top gainers.

Today, the Sensex, which is a barometer of the Indian stock market, saw a mixed bag of performances from its listed companies. Here’s a simple breakdown of what happened:

Winners:

- ICICI Bank

- Bajaj Finserv

- Infosys

- Tata Steel

- Axis Bank

These companies saw their stock prices rise, contributing positively to the Sensex.

Losers:

- Titan

- Reliance Industries

- Tech Mahindra

- Asian Paints

- IndusInd Bank

Unfortunately, these companies experienced a drop in their stock prices today, pulling the Sensex down.

Market Update at 3 pm: At 3 pm, the Sensex was down slightly by 0.05%, while the Nifty, another important index, was also down by 0.11%. This means overall, the market was experiencing a slight dip from its recent highs.

Angel One’s Fund Raise: Angel One, a prominent financial services company, successfully raised ₹1,500 crore through Qualified Institutional Placement (QIP). This funding will support the company’s growth plans and meet its financial obligations.

Insights into Chemical and Cement Sectors: Experts from Prabhudas Lilladher provided insights into the chemical and cement sectors. They anticipate challenges for chemical companies due to various factors including demand pressure and competition from China. However, they expect a modest recovery in the near term. In the cement sector, they foresee strong volume growth for certain companies despite weak pricing, indicating potential opportunities for investors.

Potential Acquisition by Dixon Technologies: Dixon Technologies announced its plans to acquire a majority stake in Ismartu India. This move is subject to regulatory approvals and could expand Dixon’s presence in the market.

Overall, today’s market movements reflect a mixed sentiment, with some sectors facing challenges while others show promise. Investors will need to carefully assess the landscape to make informed decisions.

Sensex Today Live: This PSU real estate stock is up 260% in a year. Are there more gains ahead?

Sensex Today Live: The real estate industry in India is currently experiencing a golden era. The demand is so robust that not even escalating interest rates can dampen it. The industry has witnessed an extraordinary rebound, with the Nifty Realty index skyrocketing nearly 100% in FY24.

Sensex Today Live: Indian banks are battling the worst deposit crunch in 20 years

Sensex Today Live: In the fiscal year 2023-24, Indian banks faced challenges in attracting deposits, despite a surge in credit growth. The Reserve Bank of India’s (RBI) data revealed that the credit-deposit ratio reached its peak in at least two decades, as loan disbursements increased across various categories, including home loans and consumption loans.

The credit-deposit (CD) ratio, which signifies the proportion of a bank’s deposit base used for loans, stood at 80% – the highest since 2005, the earliest year for which this ratio is available, according to RBI data. The data for FY24 is up to March 22, marking the last fortnight of the previous financial year.

Sensex Today Live: 1 pm Market Update

Sensex Today Live: Indian benchmark indices were at record highs on Tuesday, led by robust expectations of strong Q4 results this earnings season.

At 1 pm, Sensex was up 130.11 points, or 0.17%, at 74,872.61, and Nifty was up 23.05 points, or 0.1%, at 22,689.35.

Sensex Today Live: Are IDBI Bank’s potential suitors good enough? RBI is checking

Sensex Today Live: The protracted process of IDBI Bank’s privatization appears to be gaining momentum, with the central bank scrutinizing the eligibility of prospective bidders.

Initial bids for the government’s majority stake in IDBI Bank have been submitted by entities including CSB Bank, backed by Prem Watsa, Kotak Mahindra Bank, and Emirates NBD, as per media reports. The Reserve Bank of India (RBI) is presently assessing whether these potential bidders meet its ‘fit and proper criteria’ for operating a financial services institution, as informed by two individuals familiar with the situation.

Sensex Today Live: Prabhudas Lilladher, Co. Head of Research – Institutional Equities, Swarnendu Bhushan, believes that the Q4 earnings preview indicates an operationally better quarter for oil and gas businesses.

Operating Profit Projections: The operating profit for the Indian Oil & Gas sector is anticipated to see a 6% quarter-on-quarter (QoQ) improvement, reaching ₹97,800 crore. This indicates a positive trajectory for the sector’s financial performance.

Upstream Companies Outlook: Companies like ONGC and OIL India are expected to witness marginal improvements in production. Their net crude realization is projected to be around US$77.5/bbl after accounting for windfall tax. Similarly, gas realization rates are anticipated to remain stable QoQ at US$6.5/mmBtu.

City Gas Distribution (CGD) Companies: CGD companies are expected to experience notable year-on-year (YoY) volume growth ranging from 7% to 12%. This growth is expected to contribute to strong EBITDA (standard cubic meter) amidst a decline in spot LNG prices.

Oil Marketing Companies (OMCs): OMCs are forecasted to report moderate Gross Refining Margins (GRMs) and Gross Marketing Margins (GMMs). Despite this, there’s a positive outlook for Reliance Industries Limited (RIL), with expectations of improved QoQ results driven by stronger refining margins.

Analyst Recommendations: Various analyst recommendations have been provided for key players in the sector:

- RIL: Analysts suggest a downgrade from ‘Accumulate’ to ‘Hold’ rating.

- GAIL: Downgrade from ‘REDUCE’ to ‘SELL’ rating.

- HPCL: Rerate from ‘SELL’ to ‘REDUCE’ post-correction in stock price.

- BPCL and IOCL: Recommendations to ‘SELL’ with specific target prices.

- MRPL: Recommendation to ‘SELL’ with a specific target price.

- Oil India and ONGC: ‘ACCUMULATE’ and ‘HOLD’ ratings respectively, with target prices provided.

City Gas Distribution Companies and Others:

- Gujarat Gas, IGL, and MGL: Expectations of improved operating profitability.

- Petronet: Recommendation to ‘SELL’ with a specific target price.

- GSPL: Recommendation to ‘ACCUMULATE’ with a specific target price.

With the help of these insights, investors will be better equipped to decide what to invest in the oil and gas industry. As usual, before making any financial obligations, careful investigation and consideration of professional advice are crucial.

Sensex Today Live: 11 am Market Update

Sensex Today Live: Indian benchmark indices were at record highs on Tuesday, led by robust expectations of strong Q4 results this earnings season.

At 11 am, Sensex was up 312.22 points, or 0.42%, at 75,054.72, and Nifty was up 78.80 points, or 0.35%, at 22,745.10.

Stock Market Today Live : Gaining Asian peers, Gift Nifty futures indicate strong open for Indian markets

Stock Market Today Live : Markets in India were expeceted to open on a positive note, following gains in Asian peers, with a focus on industrial metal company stocks.

In India, at 8:16 am, Gift Nifty futures were trading at 22,830, more than 150 points ahead of Nifty 50’s Monday close of 22,666.30, indicating a robust opening for Indian benchmark indices that were likely to test fresh all-time highs in Tuesday’s trading session.

Industrial metals prices extended their gains on Tuesday with expectations of a worldwide manufacturing rebound, while Asian shares crept up a little more cautiously ahead of this week’s U.S. inflation data and a crucial European Central Bank meeting.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.2%. Japan’s Nikkei rose 0.6%.

Shanghai copper futures were up 1% at a two-year high and have gained more than 10% in a month. Zinc made a five-month high in Shanghai, where Aluminium made a 22-month peak on Monday.

Even iron ore, battered by China’s property downturn, steadied above $100 a tonne in Singapore.

On Monday, data showed German industrial production rising more than expected in February.

Last week, data showed U.S. manufacturing growing for the first time in one-and-a-half years. China’s manufacturing activity expanded for the first time in six months in March.

Precious metals have been soaring, too, with gold hovering just below a record high of $2,353 hit on Monday. Spot gold has risen nearly 14% this year.

Silver hit its highest since mid-2021 on Monday and platinum has also shot higher. Brent crude is below recent peaks but clinging above $90 a barrel at $90.62.

Chinese stocks have not joined the party, though Hong Kong’s Hang Seng was 1.2% higher in early trade and China proxies such as the Antipodean currencies have been rallying.

For global stock markets, bonds and currencies, the main focus this week is on U.S. inflation data due on Wednesday and the European Central Bank meeting on Thursday.

Expectations for U.S. rate cuts have been evaporating and where in January markets had expected more than 150 basis points in cuts, investors now are not even sure of half that many.

Annualised headline U.S. inflation is seen rising to 3.4% in March from 3.2% a month earlier. U.S. two-year yields, which track short-term interest rate expectations, are their highest since late November at 4.801%, while ten-year yields also hit 2024 highs of 4.46% on Monday.