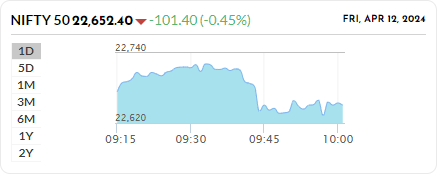

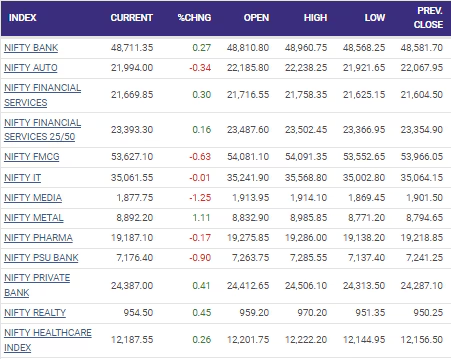

Stock Market Today: The Sensex closed 20 points, or 0.03 percent, lower at 75,390.50, while the Nifty 50 fell 25 points, or 0.11 percent, to 22,932.45.

Stock market today: Indian stock market benchmarks, the Nifty 50 and the Sensex, closed flat after reaching new intraday highs on Monday, May 27, on profit booking at higher levels amid mixed global indications.

After beginning higher, the Sensex and Nifty 50 reached new all-time highs of 76,009.68 and 23,110.80, respectively, during the session. Both indices, however, failed to maintain gains, and profit-taking at higher levels resulted in minor losses.

The Sensex completed the day 20 points lower, or 0.03 percent, at 75,390.50, while the Nifty 50 fell 25 points, or 0.11 percent, to 22,932.45.

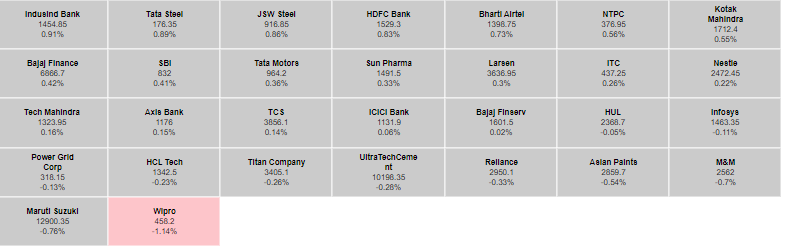

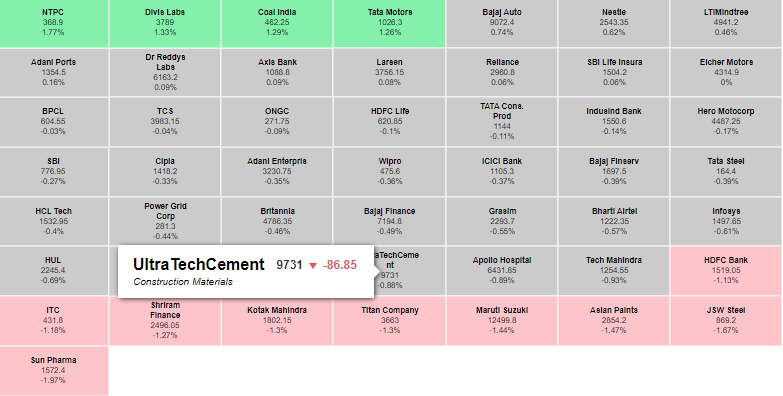

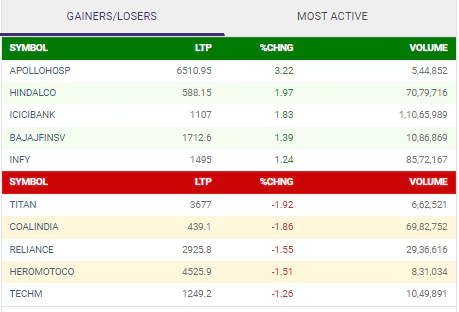

Heavyweight stocks including Reliance Industries, ITC, and Mahindra ended up being the Nifty 50’s top drags. In contrast, the index received the most support from HDFC Bank, Axis Bank, and Larsen & Toubro.