Sensex Today – Stock Market LIVE Updates: The Gift Nifty saw big gains from Divis Labs, Adani Ports, Hindalco, NTPC, and Tata Steel, while Adani Enterprises, Wipro, Eicher Motors, Hero MotoCorp, and Dr Reddy’s Labs fell.

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 75,554.67 | 144.28 | +0.19% |

| Nifty 50 | 22,985.45 | 28.35 | +0.12% |

| Nifty Bank | 49,253.55 | 281.90 | +0.58% |

| Category | Stock/Sector | Prices | Change | Change% |

|---|---|---|---|---|

| Biggest Gainer | Divis Labs | 4,351.40 | 229.00 | +5.56% |

| Biggest Loser | Adani Enterpris | 3,294.70 | -90.25 | -2.67% |

| Best Sector | Nifty Pharma | 19,304.00 | 184.50 | +0.96% |

| Worst Sector | Nifty Energy | 41,363.40 | -271.30 | -0.65% |

Sensex Today | Nifty Media down nearly 1 %; DB Corp, Dish TV fall 2-4%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| DB Corp | 279.15 | -4.6 | 116.88k |

| Dish TV | 16.70 | -2.34 | 6.31m |

| Sun TV Network | 653.85 | -1.72 | 169.42k |

| TV18 Broadcast | 43.75 | -1.69 | 1.23m |

| Zee Entertain | 149.20 | -1.62 | 5.08m |

| Network 18 | 81.65 | -0.67 | 182.50k |

| PVR INOX | 1,334.30 | -0.35 | 92.50k |

Commodity Check | Gold recovers from two-week low as traders await US inflation data.

Gold prices rose on Monday, recovering from a two-week low set the previous session, as traders assessed diminishing chances for US interest rate reduction ahead of a key inflation report anticipated later this week.

Spot gold was up 0.5% at $2,346.31 per ounce after reaching its lowest level since May 9 at $2,325.19 on Friday. U.S. gold futures increased 0.6% to $2,347.60.

Bullion peaked at $2,449.89 last week, but has since fallen by more than $100.

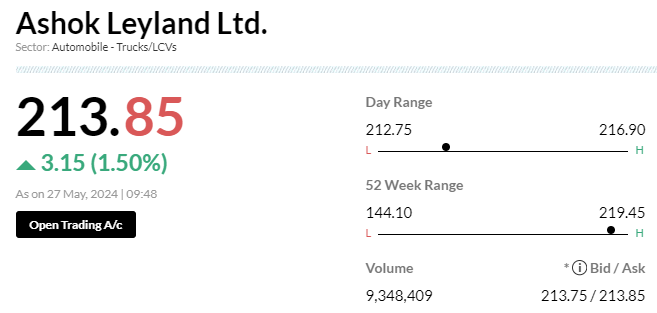

Jefferies keeps hold rating on Ashok Leyland, target raises to Rs 205

- 1 Q4 EBITDA/PAT grew 25-36 percent YoY and 9-14 percent above estimate.

- 2 India’s truck industry growth has moderated from 45 percent CAGR over FY21-23 to flat in FY24.

- 3 Expect a capex-led economic cycle to fuel demand growth ahead.

- 4 Company’s improving margin trajectory.

- 5 Expect stock to be rangebound until demand visibility improves.

- 6 Stock is already at 5.2x FY25 PB on consensus versus last cycle peak of 5.8x.

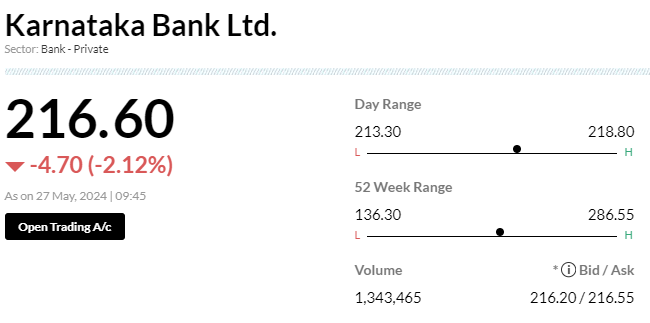

Karnataka Bank shares fall as Q4 profit dips 22%

1 Profit tanks 22.5 percent to Rs 274.2 crore Vs Rs 353.8 crore

2 Net interest income declines 3 percent to Rs 834 crore Vs Rs 860 crore

3 Pre-Provision Operating Profit drops 27.1 percent to Rs 499.8 crore Vs Rs 685.8 crore

4 Provisions down 27 percent at Rs 184.7 crore Vs Rs 253.3 crore

5 Net NPA rises to 1.58 percent Vs 1.55 percent (QoQ)

6 Gross NPA drops to 3.53 percent Vs 3.64 percent (QoQ)

Sensex Today | Tera Software, MM Forgings, among others witness huge volume surge

| Company | CMP | Chg(%) | Today Vol | 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|---|---|

| Tera Software | 59.75 | 16.02% | 225.38k | 13,657.40 | 1,550.00 |

| Tridhya Tech | 34.90 | 17.11% | 117.00k | 9,600.00 | 1,119.00 |

| Ahlada Engineer | 151.80 | 20.00% | 650.71k | 68,068.00 | 856.00 |

| MM Forgings | 1,230.00 | 9.11% | 227.11k | 36,593.60 | 521.00 |

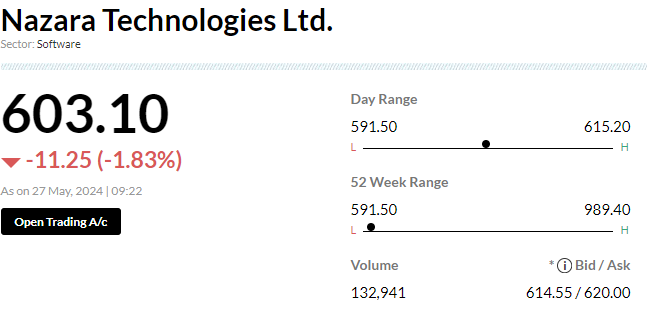

| Nazara | 619.85 | 0.90% | 555.88k | 92,737.40 | 499.00 |

| Vaidya Sane Ayu | 150.50 | -16.83% | 26.80k | 4,720.00 | 468.00 |

| Krishna Defence | 515.65 | 13.22% | 174.50k | 31,800.00 | 449.00 |

| Astra Microwave | 896.20 | 12.03% | 2.65m | 575,102.60 | 360.00 |

| DOMS Industries | 1,874.40 | 3.93% | 196.04k | 43,966.60 | 346.00 |

| Glenmark | 1,106.40 | 6.80% | 1.68m | 417,702.60 | 302.00 |

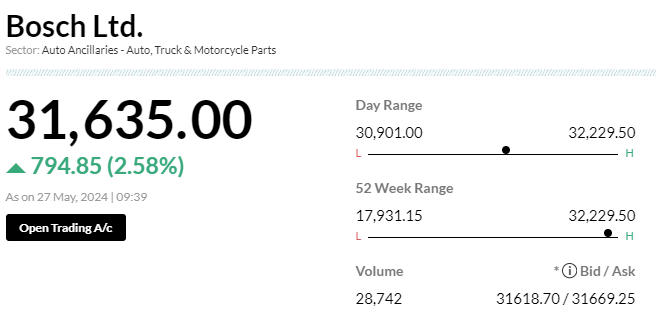

Bosch shares rise 2% on better Q4 numbers

1 Profit grows 41.5 percent to Rs 564.4 crore Vs Rs 398.9 crore

2 Revenue increases 4.2 percent to Rs 4,233.4 crore Vs Rs 4,063.4 crore

3 Board recommends a final dividend of Rs 170 per share

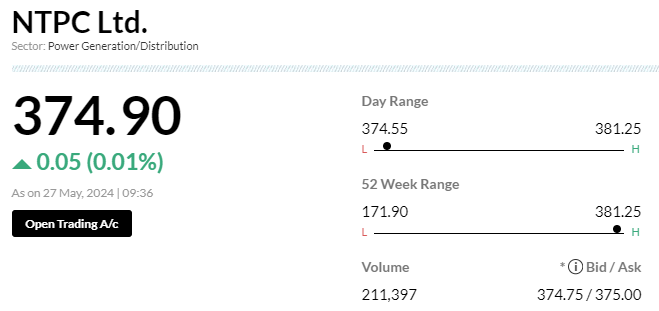

NTPC shares trade flat post Q4 earnings

1 Profit falls 2 percent to Rs 5,556.4 crore Vs Rs 5,672.3 crore

2 Revenue rises 2.9 percent to Rs 42,532.2 crore Vs Rs 41,317.9 crore

Q4 (Consolidated YoY)

1 Profit surges 33 percent to Rs 6,490 crore Vs Rs 4,871.6 crore

2 Revenue increases 7.6 percent to Rs 47,622 crore Vs Rs 44,253.2 crore

3 Other income more than doubled to Rs 1,194.5 crore Vs Rs 491.8 crore

4 Board recommends the final dividend at Rs 3.25 per share

Nifty Bank index up 0.4%; IndusInd Bank, PNB, HDFC Bank among major gainers

| Company | CMP (₹) | Chg (%) | Volume |

|---|---|---|---|

| IndusInd Bank | 1,456.70 | 1.03 | 186.31k |

| PNB | 127.45 | 0.79 | 3.21m |

| HDFC Bank | 1,528.95 | 0.77 | 1.28m |

| Bandhan Bank | 187.70 | 0.75 | 884.88k |

| AU Small Finance | 624.95 | 0.69 | 341.05k |

| Kotak Mahindra | 1,712.80 | 0.55 | 248.73k |

| Federal Bank | 164.15 | 0.43 | 1.31m |

| SBI | 831.45 | 0.36 | 853.38k |

| Bank of Baroda | 269.65 | 0.26 | 1.27m |

| Axis Bank | 1,175.25 | 0.11 | 742.75k |

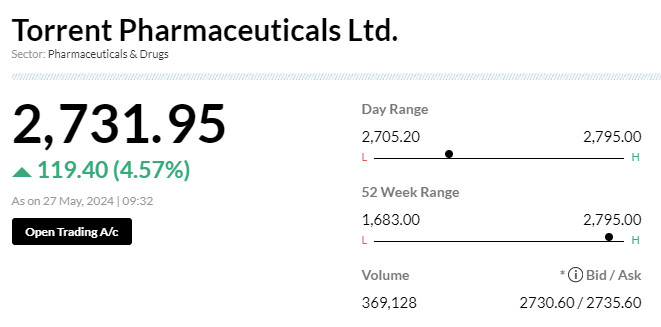

Torrent Pharma shares rise 4% as profit surges 56%

1 Q4v Profit surges 56.4 percent to Rs 449 crore Vs Rs 287 crore

2 Q4 Revenue grows 10.2 percent to Rs 2,745 crore Vs Rs 2,491 crore

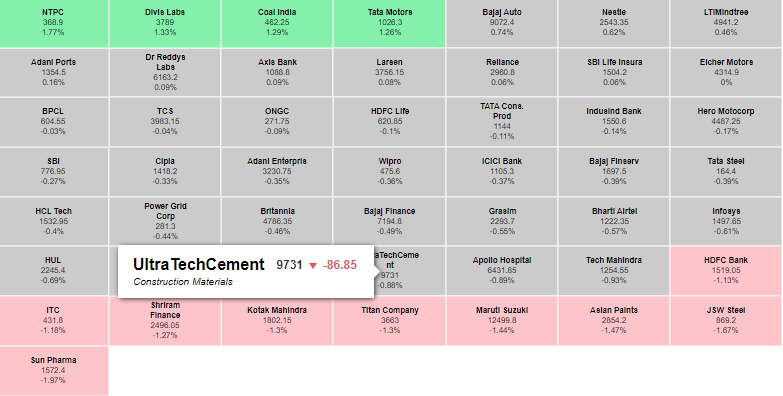

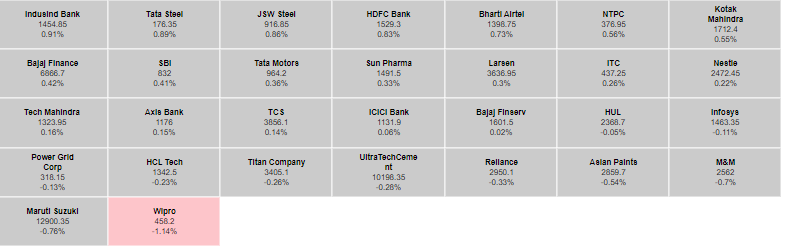

Gainers and Losers on the BSE Sensex in the early trade

SENSEX Market Map

4.88 million shares of Nazara Technologies trade in a bunch: Bloomberg

Founder Mitter Infotech sold 6.38 percent stake via block to existing investor, Plutus

Cochin Shipyard shares gain 6% as Q4 profits up 558%

1 Profit spikes 558.1 percent to Rs 258.88 crore Vs Rs 39.3 crore

2 Revenue jumps 114.3 percent to Rs 1,286 crore Vs Rs 600 crore

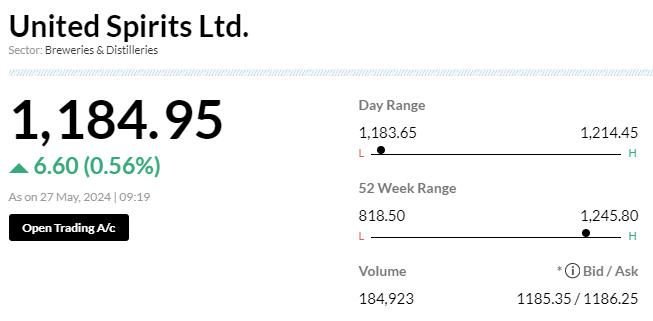

United Spirits shares gain on better Q4 earnings

1 Profit jumps 136.3 percent to Rs 241 crore Vs Rs 102 crore

2 Revenue (excluding excise duty) climbs 11.2 percent to Rs 2,783 crore Vs Rs 2,503 crore

3 EBITDA rises 42.1 percent to Rs 334 crore Vs Rs 235 crore

4 EBITDA margin expands 260 bps to 12 percent Vs 9.4 percent

Opening Bell | Nifty opens above 23,000

1 Q4 EBITDA/PAT grew 25-36 percent YoY and 9-14 percent above estimate.

2 India’s truck industry growth has moderated from 45 percent CAGR over FY21-23 to flat in FY24.

3 Expect a capex-led economic cycle to fuel demand growth ahead.

4 Company’s improving margin trajectory.

5 Expect stock to be rangebound until demand visibility improves.

6 Stock is already at 5.2x FY25 PB on consensus versus last cycle peak of 5.8x.

On May 27, the Indian benchmark indices opened higher, with the Nifty trading above 23,00.

The Sensex rose 214.20 points, or 0.28 percent, to 75,624.59, while the Nifty advanced 57.40 points, or 0.25 percent, to 23,014.50. About 1806 shares rose, 746 fell, and 165 remained constant.

The Nifty saw big gains from Divis Labs, Adani Ports, Hindalco, NTPC, and Tata Steel, while Adani Enterprises, Wipro, Eicher Motors, Hero MotoCorp, and Dr Reddy’s Labs fell.

Sensex Today | Market to witness volatility, says Prashanth Tapse, Senior VP (Research), Mehta Equities

- Q4 EBITDA/PAT grew 25-36 percent YoY and 9-14 percent above estimate.

- India’s truck industry growth has moderated from 45 percent CAGR over FY21-23 to flat in FY24.

- Expect a capex-led economic cycle to fuel demand growth ahead.

- Company’s improving margin trajectory.

- Expect stock to be rangebound until demand visibility improves.

- Stock is already at 5.2x FY25 PB on consensus versus last cycle peak of 5.8x.

Nifty traders should brace themselves for a week of potential volatility, driven by six major catalysts: Exit Poll (June 1st), May F&O expiry (May 30th), US GDP (May 30th), India’s GDP (May 31st), US PCE Inflation (May 31st), and May Auto Sales (June 1st).

Despite Wall Street’s closure on Monday for Memorial Day, Nifty buyers remain confident, buoyed by investor optimism about the general elections and a decline in oil prices to $77 per barrel.

Furthermore, Vodafone Idea’s Rs 18,000-crore FPO anchor lock-in period ends on May 27th. Following corrective losses, stocks such as Maruti, GAIL, and Reliance Industries have been given bullish outlooks.

Recommended stock: GAIL (CMP 205), with aims of 215/221 and aggressive targets of 243.

Preferred trades: Nifty (22957) – buy on dips between 22800-22850 with targets at 23100/23351 and aggressive targets at 23500-23750; Bank Nifty (48972) – buy at CMP with targets at 49300/50000 and aggressive targets at 50500-51000.

Currency Check | Rupee opens flat

Indian rupee opened flat at 83.09 per dollar on Monday versus Friday’s close of 83.10.

Sensex Today | Market trades higher at pre-opening

Benchmark indices are trading firm in the pre-opening session.The Sensex was up 233.86 points or 0.31 percent at 75,644.25, and the Nifty was up 92.20 points or 0.40 percent at 23,049.30. About 5 shares advanced, 2 shares declined, and 3790 shares unchanged.

Sensex Today | Nifty can move towards 23200-23500, says Deven Mehata, Research Analyst at Choice Broking

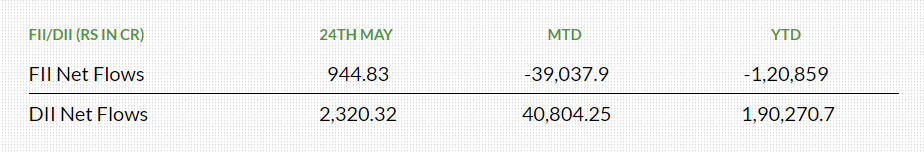

The benchmark Sensex and Gift Nifty indices are expected to open flat on May 27, following GIFT Nifty trends indicating a loss of just 7 points for the broader index. Gift Nifty can find support at 22,900 followed by 22,850 and 22,800. On the higher side, 23,050 can be an immediate resistance, followed by 23,100 and 23,200.The charts of Bank Nifty indicate that it may get support at 48,800, followed by 48,600 and 48,500. If the index advances, 49,100 would be the initial key resistance, followed by 49,300 and 49,400.Foreign institutional investors remained net buyers as they bought Indian equities worth Rs 944.83 crore worth of shares on May 24. On the other hand, domestic institutional investors bought Rs 2,320.32 crore worth of equities on the the same day.INDIAVIX was positive on Friday and closed higher, Up by 1.54 percent and is currently trading at 21.7100.On Friday Nifty made a fresh all-time high above 23000 levels. Traders are advised to purchase on dips near the strong support at 22800 levels with a stop loss of 22700 on closing basis. On the higher side Nifty can move towards 23200 and 23500 in coming days. Bank Nifty has also shown strength and hence it can also move higher towards the next resistance of 49400-49600 levels.

Also Read Adani Group MCAP Recovers $200 Billion as it Rejects Charges of Coal Fraud.

Sensex Today | Rail Vikas Nigam bags Rs 187.34 crore project from Maharashtra Metro Rail Corp

The company has emerged as the lowest bidder (L1) for a project worth Rs 187.34 crore from Maharashtra Metro Rail Corporation (Nagpur Metro). The project involves the construction of six elevated metro stations in Phase 2.

Sensex Today, Gift Nifty | Adani Ports to replace Wipro in BSE Sensex

Adani Ports and Special Economic Zone will replace Wipro on the BSE Sensex, effective June 24.

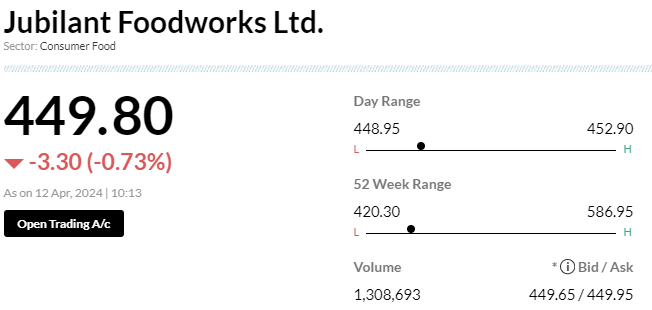

In addition, the S&P BSE 100 index will contain REC, HDFC AMC, Canara Bank, Cummins India, and Punjab National Bank, while Page Industries, SBI Card, ICICI Prudential Life Insurance, Jubilant FoodWorks, and Zed Entertainment Enterprises would be excluded.

Trent will replace Divis Laboratories on the S&P BSE Sensex 50 index.

Stock Market LIVE Update | Aster DM in agreement to expands CMI Hospital

Aster DM Healthcare has signed into an Addendum Hospital Operation and Management Agreement with Cauvery Medical Centre Private Limited to expand the existing Aster CMI Hospital premises by about 350 beds.

Sense Today | Biocon, GNFC, Vodafone Idea under F&O Ban list

Biocon, GNFC, Vodafone Idea, Bandhan Bank, Hindustan Copper, India Cements, National Aluminium Company, Piramal Enterprises, Punjab National Bank.

Sensex Today | Tata Steel board meeting on May 29

At its meeting on May 29, 2024, Tata Steel’s board of directors will discuss issuing unsecured non-convertible debentures through private placement.

Sensex Today | FII & DII Data

Sensex Today, Gift Nifty | USFDA classifies Aurobindo Pharma’s Telangana units as OAI

From January 22 to February 2, the United States Food and Drug Administration (US FDA) performed an examination at Unit III, a formulation manufacturing facility owned by the company’s subsidiary, Eugia Pharma Specialities, in Pashamylaram, Telangana. As a result, the US FDA designated this facility’s inspection categorization status as Official Action Indicated (OAI).

Sensex Today, Gift Nifty| NTPC, RVNL, Astra Microwave top stocks to watch out today

- NTPC: Q4 consolidated profit rises 33% to Rs 6,490 crore from Rs 4,871.6 crore.

- Karnataka Bank: Q4 standalone profit down 22.5% to Rs 274.2 crore from Rs 353.8 crore.

- Cochin Shipyard: Q4 profit rises 558.1% to Rs 258.88 crore from Rs 39.3 crore.

- United Spirits: Q4 consolidated profit rises 136.3% to Rs 241 crore from Rs 102 crore.

- Rail Vikas Nigam has emerged as the lowest bidder (L1) for a project valued Rs 187.34 crore.

- Astra Microwave Products: Q4 consolidated profit rises 302.3% to Rs 54.4 crore from Rs 13.5 crore.

Earnings Watch | Natco Pharma, Borosil Renewables, among others to report Q4 results today

Life Insurance Corporation of India, Astrazeneca Pharma, Borosil Renewables, Flair Writing Industries, Jubilant Industries, Natco Pharma, National Aluminium Company, NMDC, Peninsula Land, Sumitomo Chemical India, TVS Supply Chain Solutions, and West Coast Paper Mills will announce theri earning today.

Brokerage Call | Morgan Stanley keeps overweight rating on NTPC, target Rs 390

1 Company’s parent earnings missed estimates due to fixed cost under recoveries

2 Consolidated PAT was a miss driven by lower profit contributions from subsidiaries

3 Company has a strong RE portfolio of 23.2 GW; RE IPO possible by Oct/Nov-24

Brokerage Call | Jefferies keeps hold rating on Ashok Leyland, target raises to Rs 205

1 Q4 EBITDA/PAT grew 25-36 percent YoY & 9-14 percent above estimate

2 India’s truck industry growth has moderated from 45 percent CAGR over FY21-23 to flat in FY24

3 Expect a capex-led economic cycle to fuel demand growth ahead

4 Like company’s improving margin trajectory

5 Believe stock will be rangebound until demand visibility improves

6 Stock is already at 5.2x FY25 PB on consensus versus last cycle peak of 5.8x

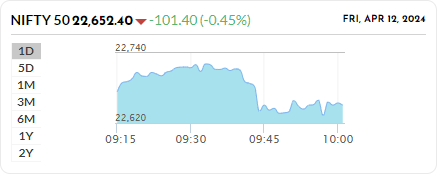

Sensex Today | GIFT Nifty indicates a flat start

Trends on GIFT Nifty indicate a flat start for the broader index in India, with a loss of 5 points. The Nifty futures were trading around 23,034.50 level.

Commodity Check | Oil prices little changed as markets look to OPEC+ meeting

Oil prices were in a holding pattern in early Asian trading on Monday as markets awaited an OPEC+ meeting on June 2 where producers are expected to discuss maintaining voluntary output cuts for the rest of the year.The Brent crude July contract inched up 11 cents to $82.23 a barrel. The more-active August contract LCOc2 rose Gift Nifty 13 cents to $81.97.U.S. West Texas Intermediate (WTI) crude futures rose 13 cents to $77.85.