There is talk that the market’s confidence has decreased in the fact that the BJP is going to win the 2024 Lok Sabha elections. When markets fall, people start thinking that there is something wrong with the predictions of election results. Such people assume that the market knows everything. They feel that the market is predicting the victory of the BJP. If this does not happen the market will fall. If this is the case today, wouldn’t this have been the case five years ago? Let us look at the last Lok Sabha elections.

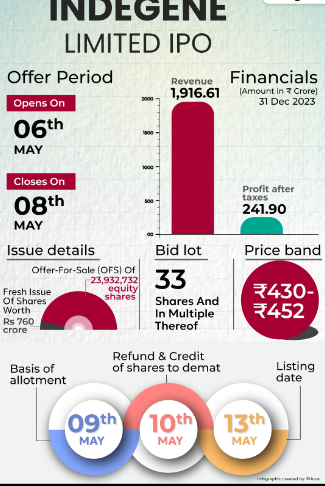

Indegene Share Price Starts Strongly, Opening at ₹655 on NSE with a 45% Premium.

Voting was held in seven phases

In Lok Sabha Election 9 and others got 51 seats. Voting was held on 97 seats in the second phase on April 18. Of these, BJP got 38 seats, Congress 12, and others 47 seats. Voting was held on 115 seats on 23 April. 67 seats were won by BJP, 19 by Congress and 29 by others. Of the 71 seats that went to polls on April 29, 49 went to BJP, 2 to Congress and 20 to others.

The Last Phase Of Voting

Voting took place on 51 seats on May 6, out of which 42 went to BJP, 1 to Congress, and 8 to others. Voting was held on 59 seats on May 12, out of which 45 seats were won by BJP, 1 by Congress, and 13 by others. A total of 59 seats were to be decided in the last phase of voting on May 19. Of these, BJP had got 31. 8 were won by Congress and 20 by others.

The market celebrated on May 20 after the exit poll results. But, the flat was closed on 21 May. On May 21, it closed just 100 points below the April 10 level. Looking at the performance of the market during the voting in the 2019 Lok Sabha elections, it seems that even then there was as much uncertainty in the market as there is today.