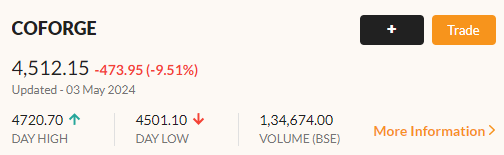

IFCI Share Price went up today, 06 May 2024, by 1.69 %. The stock closed at 52.51 per share. The stock is currently trading at 53.4 per share. Investors should monitor IFCI stock price closely in the coming days and weeks to see how it reacts to the news.

IFCI Share Price Today: On the last day of trading, IFCI’s open price was ₹54.99 and the close price was ₹52.51. The high for the day was ₹54.99 and the low was ₹51.70. The market capitalization of IFCI stood at ₹13,980.1 crore. The 52-week high for the stock was ₹71.70, and the 52-week low was ₹10.95. The BSE volume for IFCI was 4,977,411 shares traded.

IFCI share price live: Simple Moving Average

| Days | Simple Moving Average |

|---|---|

| 5 Days | 48.24 |

| 10 Days | 45.09 |

| 20 Days | 45.00 |

| 50 Days | 44.75 |

| 100 Days | 41.20 |

| 300 Days | 30.17 |

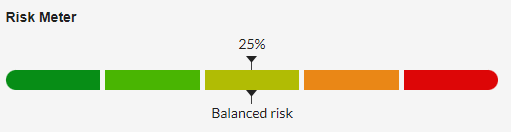

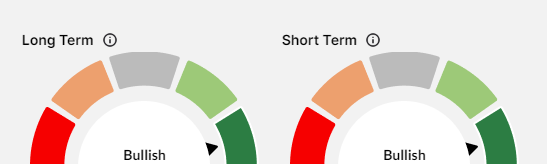

IFCI Short-Term and Long-Term Trends

As per the Technical Analysis, the short-term trend of IFCI share is Bullish and the long-term trend is Bullish

IFCI share price Today: Volume traded till 2 PM is -62.74% lower than yesterday

The volume of IFCI traded until 2 PM is 62.74% lower than yesterday, with the price trading at ₹52.98, a decrease of 0.9%. Volume traded is a crucial factor, along with price, for analyzing trends. A positive price movement accompanied by higher volume indicates a sustainable upward trend, while a negative price movement with higher volume could signal further price declines.

IFCI share price Live: Hourly Price Movement Update

IFCI reached a peak of 53.6 and a low of 52.42 in the previous trading hour. In the last hour, the stock price surpassed the hourly resistance at 53.05 (Resistance level 1), suggesting bullish momentum.

The hourly support and resistance levels to watch out for in the next hour are mentioned below.

| Resistance Levels | Price | Support Levels | Price |

|---|---|---|---|

| Resistance 1 | 53.76 | Support 1 | 52.58 |

| Resistance 2 | 54.27 | Support 2 | 51.91 |

| Resistance 3 | 54.94 | Support 3 | 51.4 |

IFCI share price update: IFCI is trading at ₹53.4, up 1.69% from yesterday’s ₹52.51

IFCI share price is at ₹53.4 and is still trading between the key support and resistance levels of ₹51.15 and ₹54.5 on a daily timeframe. If it crosses the support of ₹51.15 then we can expect a further bearish movement. On the other hand, if the price crosses 54.5 then it will lead to a bullish movement.

IFCI share price NSE Live: Volume traded till 1 PM is -63.72% lower than yesterday

The volume of IFCI traded until 1 PM is down by 63.72% compared to yesterday, with the price trading at ₹53.28, a decrease of 1.47%. Volume traded is a key indicator, along with price, for analyzing trends. A positive price trend accompanied by increased volume indicates a sustainable upward movement, while a negative price trend with higher volume could signal further price declines.

IFCI share price Today: Hourly Price Movement Update

IFCI’s stock traded between 53.25 and 52.65 in the previous hour. The price fell below key hourly resistances of 53.02 and 52.84, suggesting notable selling pressure. Traders holding long positions may consider exiting, while new investors can assess the possibility of a reversal if the stock is oversold on an hourly basis.

The hourly support and resistance levels to watch out for in the next hour are mentioned below.

| Resistance Levels | Price | Support Levels | Price |

|---|---|---|---|

| Resistance 1 | 53.05 | Support 1 | 52.45 |

| Resistance 2 | 53.45 | Support 2 | 52.25 |

| Resistance 3 | 53.65 | Support 3 | 51.85 |

IFCI share price NSE Live: Hourly Price Movement Update

The stock price has been moving between the levels of 53.69 and 52.91 in the last hour. Traders could consider utilizing rangebound trading strategies by purchasing near the hourly support at 52.91 and selling near the hourly resistance at 53.69.

The hourly support and resistance levels to watch out for in the next hour are mentioned below.

| Resistance Levels | Price | Support Levels | Price |

|---|---|---|---|

| Resistance 1 | 53.47 | Support 1 | 53.02 |

| Resistance 2 | 53.74 | Support 2 | 52.84 |

| Resistance 3 | 53.92 | Support 3 | 52.57 |

IFCI Short-Term and Long-Term Trends

As per the Technical Analysis, the short-term trend of IFCI share is Bullish, and the long-term trend is Bullish

IFCI share price live: Simple Moving Average

| Days | Simple Moving Average |

|---|---|

| 5 Days | 48.24 |

| 10 Days | 45.09 |

| 20 Days | 45.00 |

| 50 Days | 44.75 |

| 100 Days | 41.20 |

| 300 Days | 30.17 |

IFCI share price update: IFCI is trading at ₹53.22, up 1.35% from yesterday’s ₹52.51

IFCI share price is at ₹53.22 and is still trading between the key support and resistance levels of ₹51.15 and ₹54.5 on a daily timeframe. If it crosses the support of ₹51.15 then we can expect a further bearish movement. On the other hand, if the price crosses 54.5 then it will lead to a bullish movement.

IFCI share price NSE Live: Volume traded till 11 AM is -62.36% lower than yesterday

The volume of IFCI traded by 11 AM is 62.36% lower than the previous day, with the price at ₹53.24, down by 1.39%. Volume traded is a key indicator, along with price, for analyzing trends. A price rise accompanied by increased volume indicates a sustainable upward trend, while a drop in price with higher volume could signal further price declines.

IFCI share price Today: Hourly Price Movement Update

The stock price has been moving between 53.89 and 51.84 levels in the last hour. Traders may want to consider rangebound trading strategies by buying near the hourly support at 51.84 and selling near the hourly resistance at 53.89.

The hourly support and resistance levels to watch out for in the next hour are mentioned below.

| Resistance Levels | Price | Support Levels | Price |

|---|---|---|---|

| Resistance 1 | 53.69 | Support 1 | 52.91 |

| Resistance 2 | 54.05 | Support 2 | 52.49 |

| Resistance 3 | 54.47 | Support 3 | 52.13 |

IFCI share price Live: IFCI closed at ₹52.51 on last trading day & the technical trend suggests Bullish near term outlook

The stock traded in the range of ₹54.99 & ₹51.7 yesterday to end at ₹52.51. The stock is currently experiencing a strong bullish trend