TBO Tek share price debuts impressively, with NSE opening at ₹1,426 per share and BSE at ₹1,380, significantly higher than the issue price of ₹920. The IPO was subscribed 86.70 times, with QIBs oversubscribed at 125.51 times, NIIs at 50.60 times, and RIIs at 25.74 times.

TBO Tek share price made a stellar debut on the bourses today. On NSE, TBO Tek share price opened at Rs1,426 per share, 55% higher than the issue price of ₹920. On BSE, TBO Tek share price today opened at ₹1,380 apiece, up 50% than the issue price.

Also Read Cannes 2024 LIVE Updates : All you Need to Know About When and Where to Watch LIVE Steaming.

Market experts anticipated TBO Tek share price to open in the range of ₹1,360 to ₹1,400 per share.

On Friday, the final day of subscriptions, TBO Tek’s initial public offering was subscribed 86.70 times, according to NSE data. The segment allocated for qualified institutional buyers (QIBs) received 125.51 times subscriptions, but the non-institutional investor group received 50.60 times as many subscribers. The section for retail individual investors (RIIs) received 25.74 times subscriptions.

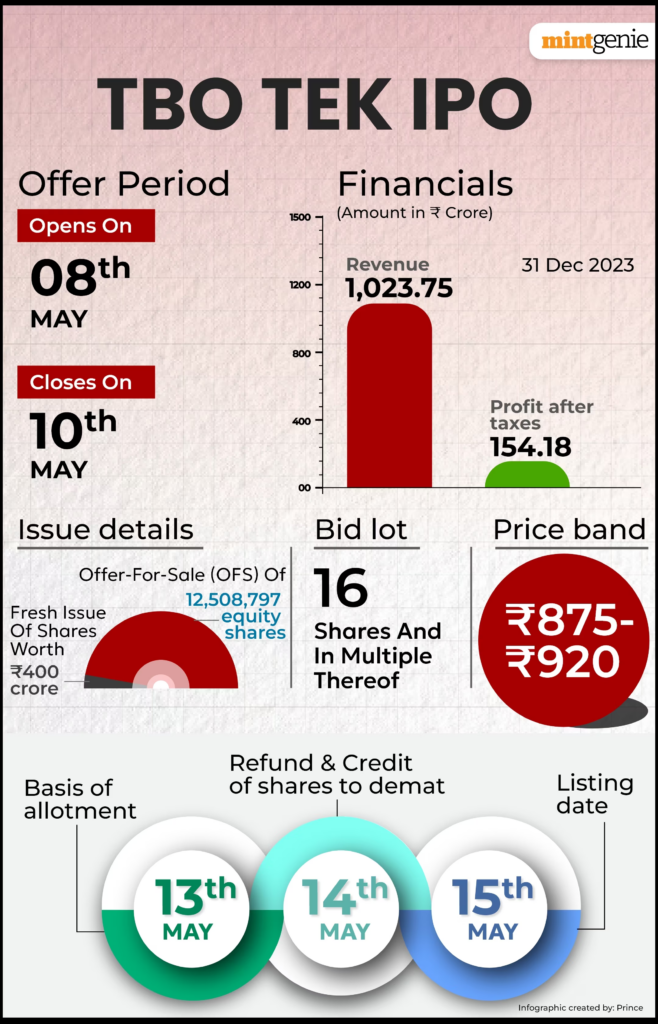

The price band for each equity share in the offering, which has a face value of Re 1, has been set between ₹875 and ₹920. 16 equity shares make up each lot in the IPO, and more lots of 16 equity shares will be issued in the future. The IPO set aside 75% of the net offer for QIBs, 15% for NIIs, and 10% for retail investors. Employees have reserved equity shares worth up to ₹3 crore.

The company streamlines the travel industry for suppliers including lodging facilities, airlines, rental cars, transfers, cruise lines, insurance, and rail companies, among others. Travel agencies and independent travel advisers are examples of retail clients; corporate clients include tour operators, travel management organisations, online travel agencies, super apps, and loyalty apps. The seamless communication made possible by the two-sided technology platform benefits each of these parties equally.

TBO Tek IPO details

TBO Tek IPO, which is worth ₹1,550.81 crore, comprises a fresh issue of ₹400 crore, and an offer-for-sale (OFS) of up to 12,508,797 equity shares of face value of Re 1 each by the promoters and other investors.

52.12 lakh shares will be offered through OFS, according to announcements made by the company’s promoters, Manish Dhingra, LAP Travel, and Gaurav Bhatnagar. The company’s two investors, Augusta TBO and TBO Korea, who own respective holdings of 19.53 percent and 11.06 percent, will sell 72.96 lakh shares.

According to the Red Herring Prospectus for TBO Tek’s IPO, corporate promoters own 51.26 percent of this online travel distributor, while public shareholders own 46.43 percent of the company.

Augusta TBO is the company’s biggest public investor, holding 19.53% of the shares. General Atlantic owns 15,635,994 company shares, or 15% of the company’s total paid-up capital.

TBO Korea owns 11,523,854 shares, or 11.06 percent of the company overall. Promoters and public shareholders own 98.54 percent of the company; the TBO ESOP Trust, an entity that is neither a promoter nor a public shareholder, owns the remaining 2.31%.

The company intends to use the offering’s net proceeds to finance the following objectives: expanding the network of buyers and suppliers; increasing the platform’s value by adding new business categories; utilizing acquired data to offer our suppliers and buyers customized travel solutions; and pursuing inorganic development through wise acquisitions and the creation of synergies with our current platform.

Axis Capital Limited, Jefferies India Private Limited, Goldman Sachs (India) Securities Private Limited, and Jm Financial Limited are the book running lead managers of the TBO Tek IPO. Kfin Technologies Limited is the issue registrar.

Also Read VNIT Nagpur Associates with the MMGEIS Program to Empower Students in Geospatial Innovation

TBO Tek IPO GMP today

TBO Tek IPO grey market premium is +350. This indicates TBO Tek share price were trading at a premium of ₹350 in the grey market, according to investorgain.com.

The expected listing price for the TBO Tek IPO is ₹1,270 per share, which is 38.04% greater than the IPO price of ₹920, given the upper end of the IPO price band and the existing premium on the grey market.

Based on the last 16 sessions of grey market activity, the IPO GMP for today indicates an increasing trajectory and a strong listing. The experts at investorgain.com state that the GMP ranges from ₹0 to ₹540.

‘Grey market premium’ indicates investors’ readiness to pay more than the issue price.