To preserve a 15-year partnership and bring back games like World of Warcraft season of Discovery (wow sod) for the largest gaming market in the world, NetEase Inc. and Microsoft Corp. Blizzard Entertainment reached a new agreement for game distribution in China.

Chinese industry investigator CN Wire believes that a formal statement restarting PC games, including World of Warcraft and Overwatch 2, wow sod forums to the Chinese market, will take place on Wednesday.

To add to the rumors, a picture of Netease CEO Ding Lei and Activision Blizzard CEO Johanna Faries meeting has surfaced on social media.

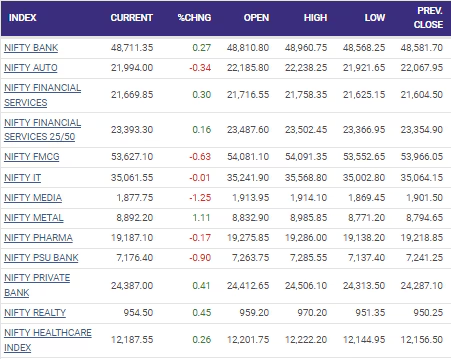

The market has spiked in response to local media reporting in China on the possible announcement, with shares of Netease rushing by as much as 5%.

NetEase Blasts Blizzard in Fiery Post as Warcraft Spat Escalates

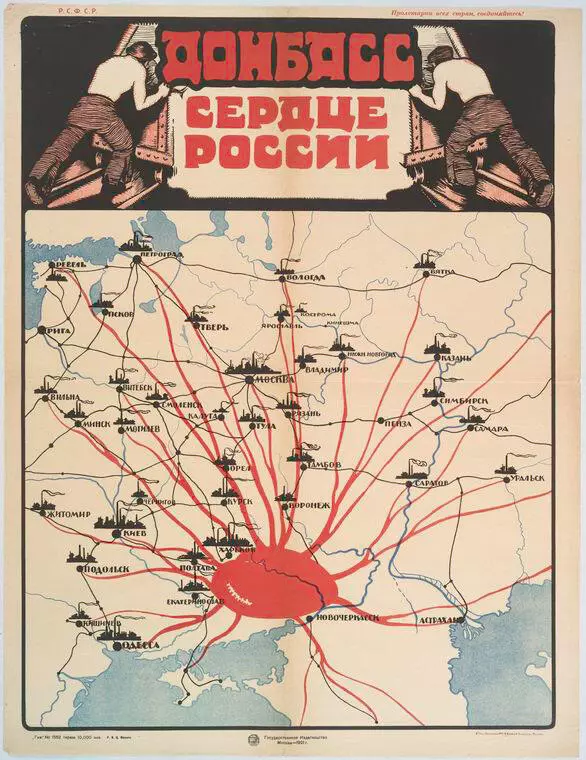

In 2008, Activision Blizzard and Netease partnered to allow Netease to release Blizzard’s games in China. This was primarily done to introduce World of Warcraft to the Chinese market at the time, but it also released Overwatch, Hearthstone, Starcraft, and Diablo in the years that followed.

The region lost access to Blizzard’s games in 2023 when the agreement expired in late 2022. The biggest 2023 title from Blizzard, Diablo 4, hasn’t been released in the area yet.

A new internal team at NetEase Games is creating the game; according to the company, they are “composed of global talent who previously worked on hit franchises such as Call of Duty and Battlefield.”

Played in third person, Marvel Rivals is a 6v6 team-based game that can be downloaded for free.